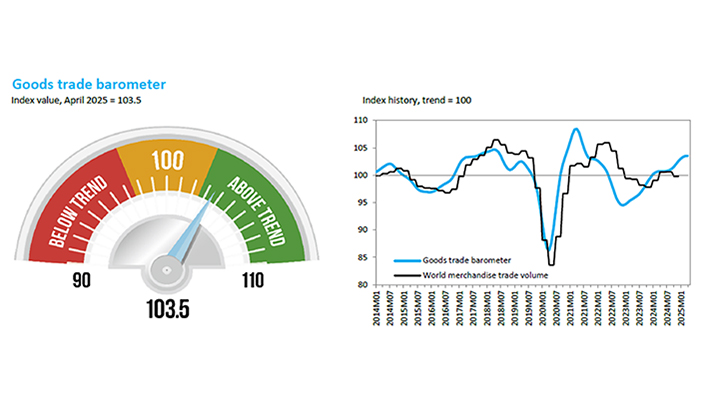

The Goods Trade Barometer is a composite leading indicator for world trade, providing real-time information on the trajectory of merchandise trade relative to recent trends. Barometer values greater than 100 are associated with above-trend trade volumes, while barometer values less than 100 suggest that goods trade has either fallen below trend or will do so in the near future.

While the current barometer reading of 103.5 (represented by the blue line in the chart) exceeds both the baseline value of 100 and the quarterly trade volume index (represented by the black line), the decline in export orders and the temporary nature of frontloading suggest that trade growth may slow in the months ahead as enterprises import less and start to draw down accumulated inventories.

The most predictive barometer component, the new export orders index (97.9), has dipped below its baseline value of 100 into contraction territory, signalling weaker trade growth later in the year. On the other hand, most other barometer components have risen above trend. Transport-related indices, including air freight (104.3) and container shipping (107.1), reflect increased movement of goods. The automotive products index (105.3) also is above trend due to resilient vehicle production and sales. The electronic components index (102.0) has climbed above trend after underperforming in 2023 and 2024. Finally, the raw materials index (100.8) shows only modest growth, just above baseline.

World merchandise trade volume growth moderated in the fourth quarter of 2024 but it is likely to rebound in the first quarter of 2025 based on the goods barometer and preliminary trade data. The WTO Secretariat’s Global Trade Outlook and Statistics report of 16 April 2025 projected stable trade growth of 2.7% for 2025 under a low-tariff scenario reflecting policy conditions at the start of the year, and a ‑0.2% contraction under actual policies in place as of mid-April. Subsequent developments, including US-China and US-UK trade agreements as well as higher tariffs on steel and aluminium, have nudged the forecast up and down slightly leaving the overall outlook basically flat at 0.1%. However, trade contraction is possible, for example if US reciprocal tariffs are reinstated, or if trade policy uncertainty spreads globally.

The full Goods Trade Barometer is available here.

Further details on the methodology can be found in the technical note here.

Share