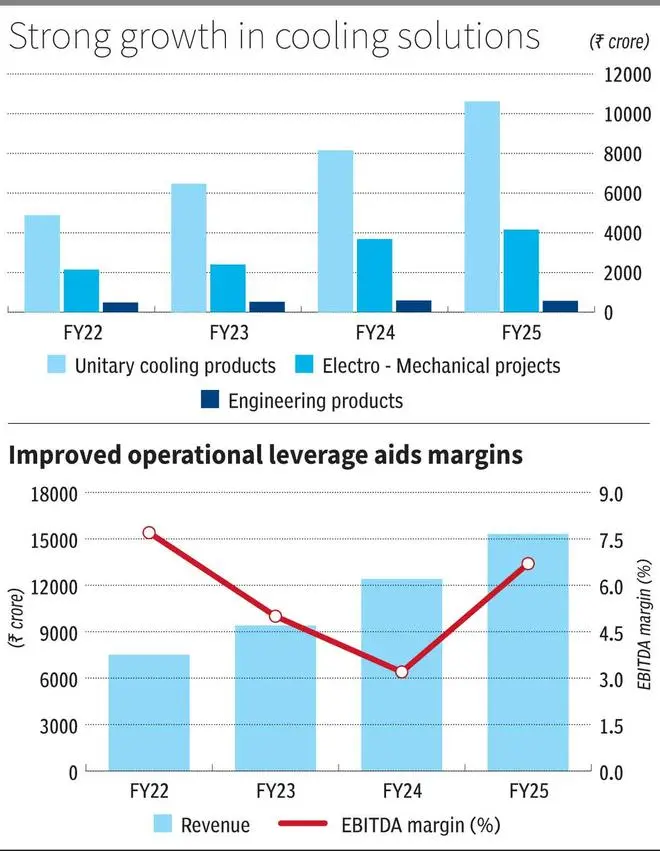

Consumer durables, led by room air conditioners (RACs), are growing at a high pace. Yet, RACs — at 7-8 per cent — are underpenetrated in India, which points to a long growth runway. Voltas, which is the leading RAC player by volumes, has delivered 28 per cent revenue CAGR in the last two years – FY23-25. The company is currently focussed on improving volume share in RAC and home appliances (washing machines and refrigerators), which may be complemented by margin focus in the longer term. We recommend investors accumulate the stock, which is currently trading at 38 times one-year forward earnings, given the trend of increasing penetration of white goods. Key risk to the call is the impact on margins from high competition and the inability to backward integrate.

Segment drivers

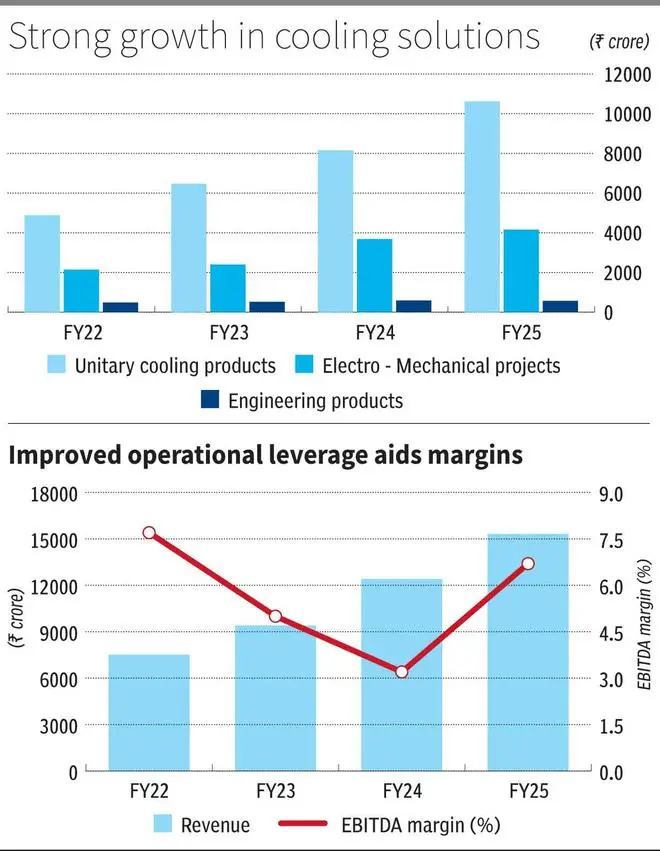

The three segments of Voltas are unitary cooling products (UCP – 69 per cent of FY25 revenues), electro–mechanical projects (EMP – 27 per cent) and engineering products (EP – 4 per cent).

The UCP division houses the RAC products (around 60 per cent of the segment), followed by commercial refrigeration (15 per cent) and air coolers (5 per cent) and commercial air conditioners.

Voltas reported UCP revenue growth of 28 per cent CAGR in FY23-25, supported by a 19 per cent market share in RACs in YTD March 2025. The company reported breaching 2.5 million RACs sold in FY25 while the industry recorded 13-14 million.

This should be boosted from the recently-commercialised Chennai plant with a capacity of one million RACs per annum constructed at ₹400 crore. The plant is slowly ramping up and is expected to fill the gap in South Indian market reach. Capacity expansion to 2-2.5 million RAC per annum will be undertaken in the next phase. This should allow Voltas to retain and even expand RAC market share when the plant hits peak utilisation in the medium term.

The EMP segment, which serves industrial solutions for cooling, plumbing and other projects, is supported by a strong order-book, both domestic and international. The international segment is driven by projects in Saudi Arabia and the UAE. A recovery in domestic private capex can support the strong growth in the segment (32 per cent CAGR in FY23-25). The pending order-book stands at 1.6 times FY25 sales and is distributed between the two markets.

The EP division (supplying products to textiles and mining industries primarily) has reported weak sales growth (4 per cent CAGR in FY23-25) owing to weakness in the primary end-user industries in India and Bangladesh. A possible recovery in domestic textiles can support the growth of the division.

The strong growth in RACs, where Voltas is the market leader, is expected to be the main driver, despite expectation of a tempered growth on a base that has rapidly expanded in the last three years. Commercial solutions (industrial refrigeration, building cooling) and water dispensers, and air coolers, which are also growing at a high pace, are expected to enable the company to deliver low double-digit revenue growth, despite weakness in the EP division.

Margin drivers

Voltas holds 49 per cent stake in Voltbek Home Appliances in partnership with Arcelik – a Turkish home appliances company started in 2020. The company results are reported as Share in profits and not consolidated in revenue line. This segment is reporting losses, as the company is in expansion phase. The losses amounted to ₹126 crore in FY25 compared to Voltas’ consolidated PAT of ₹834 crore in the period.

The company reported 56 per cent volume growth in 9MFY25 and currently holds 8.7 per cent market share in washing machines and 5.3 per cent share in refrigerators YTD. Voltas expects EBITDA break-even when volumes reach low double-digit market share. At the current pace, the partnership can be expected to contribute positively to the bottom-line in the next two-three years, which can be a big boost to the profitability of Voltas.

At the EBITDA level, Voltas reported EBITDA margin expansion of 350 bps to 6.7 per cent in FY25 compared with FY24. This has primarily been driven by expanded operations and the operating leverage that comes with it. The margin expansion from here will be evenly poised essentially to sustain volume-driven growth that the management aims for.

For the margin headwinds, the level of competition and ability to take premium prices is volatile and may not favour sellers in the medium term, including Voltas. Despite a strong showing, Voltas’ market share in RACs is moving between 19 per cent and 21 per cent owing to competition from at least 60 brands in the RAC market, including Korean and Chinese majors. Voltbek expansion will also face a similar headwinds to expansion.

The company will have few levers for margin expansion too. Operating leverage will continue. The advertising and promotion costs, which were higher even in off-season periods, can normalise after sufficient market share is achieved. Rupee depreciation has impacted raw material costs leading to lower margins, which is continuing owing to the current situation on the India-Pakistan border. The company is also impacted by a low backward integration with compressors. The recent Chennai plant is largely integrated and a ₹250-crore plant to develop compressors in-house is under proposal for the next phase after achieving desired market shares.

Voltas’ top line growth and margin levers should deliver higher earnings growth in the medium term. The one-year forward valuations have shrunk 24 per cent from the last three-year average to 38 times now. We recommend investors accumulate the stock. The management shift in focus to dual drivers of profitability and market share will be the key monitorable.

Published on May 10, 2025