This shows that beyond infrastructure, AI is stepping into the physical world – powering robotics and multimodal intelligence, including digital media.

Affle (India) is one company from the AdTech space that uses its AI driven platform in real time predictive algorithm to target and convert users.

It out as a promising player in the rapidly growing artificial intelligence and digital advertising space.

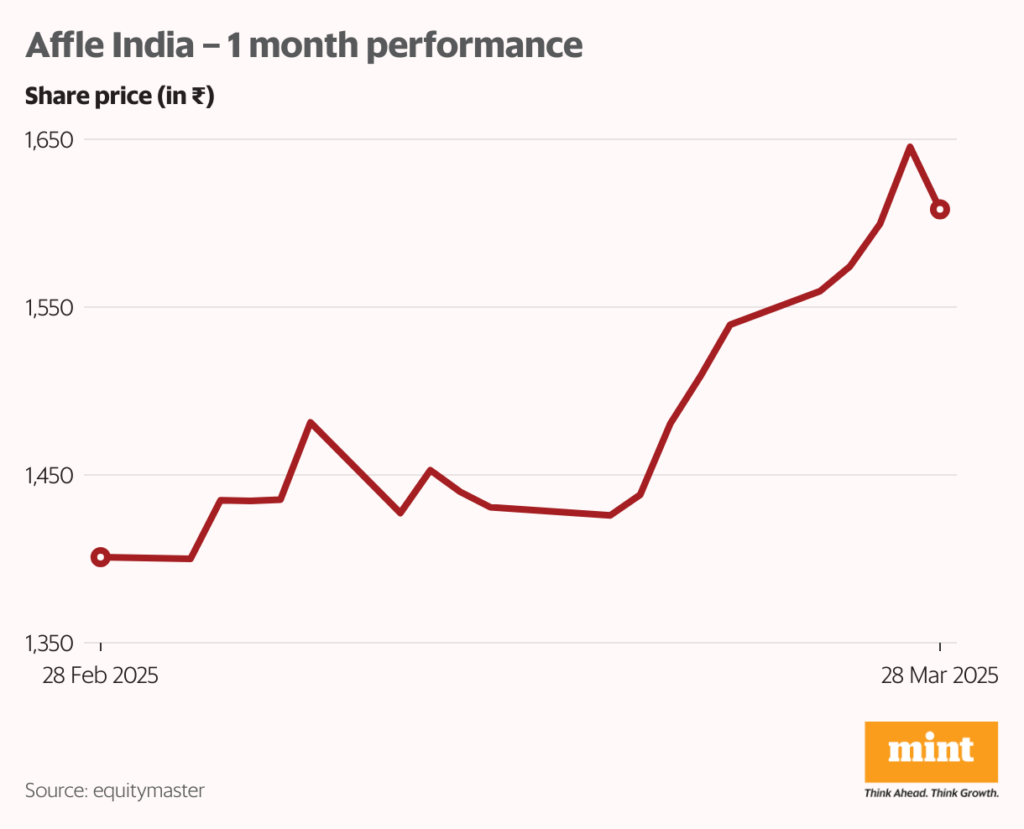

In the past one month, shares of Affle India have rallied 15%.

This begs the question of whether the stock is poised for more gains, given the massive growth trajectory of the digital advertising space, or will it face a roadblock…

Let’s take a closer look.

Move Over TV! Digital Media Revolution is Here…

In 2024, digital media overtook television for the first time, contributing 32% of the overall revenue of media & entertainment (M&E) industry.

This was followed by TV, which contributed 27%, and print media, which contributed 11%.

The Indian M&E sector is projected to grow by 7.2% in 2025 to reach 2.68 trillion.

Video market is expected to boom in the coming years and decades and Affle India has a big opportunity to capture the advertising segment which is expected to grow by 8% till 2027.

Where Affle India Fits In…

Affle has a proprietary consumer intelligence platform that transforms ads into recommendations. This helps marketers effectively identify, engage, acquire and drive transactions with their potential and existing users.

The company operates on two platforms: consumer and enterprise.

Consumer Platform: The consumer platform of Affle India helps its clients for new consumer conversions (acquisitions, engagements, and transactions) through mobile advertising, helping companies acquire customers online and offline. Affle primarily earns its revenues on a cost per converted user (CPCU) basis which comprises of three use cases viz. new user conversion (online), existing user repeat conversion (online), new/existing user conversion (offline).

Enterprise Platform: Affle provides end-to-end solutions for enterprises to enhance their engagement with mobile users. The company’s services include app development for third parties; enabling offline to online commerce for offline businesses with direct-to-consumer aspirations; enterprise grade data analytics for online and offline companies; cloud services.

Affle’s unique approach involves using a return on investment (ROI) linked cost per converted user (CPCU) model, where earnings are based on conversions and positive ROI for advertisers, rather than the traditional cost per click (CPC) and cost per mile (CPM) models.

In other words, Affle charges only when a conversion occurs – such as a purchase or registration. This approach aligns the company’s revenue with the advertiser’s success, ensuring that advertisers pay only for tangible results.

It has been successful in creating a solid platform for mobile-first digital advertising market with its proprietary tech stack, acquisitions, and continuous R&D.

Affle is currently expanding into both emerging and developed markets, which will boost its revenue. Entering developed markets and accessing premium inventories is expected to enhance the overall CPCU rate.

The company has made multiple strategic acquisitions to expand its presence across the value chain. The companies Affle acquired offered products or services that were immediately valuable for its consumer platform.

Moreover, the company possesses a strong portfolio of intellectual property, having filed 36 patents, with 10 already granted in the US and India.

Affle derives 72.9% of its revenues from India and emerging markets and the balance 27.1% from developed markets.

A Close Look at Affle India’s Financial

Affle has been able to grow its revenue at a stupendous compounded annual growth rate of 41% over the last 5 years.

The company has also been able to maintain its margins in the range of 20-25% thereby leading to an Ebitda growth CAGR of 33%.

View Full Image

At a PE of over 61, it may not seem cheap. But given the high growth prospects, the rise of connected devices and shift in consumption patterns, this is one stock that deserves to be on your watchlist.

Going ahead, Affle India’s management is targeting 20%+ revenue growth for FY25, with guidance on EBITDA and PAT growth being even higher.

To achieve this, management is exploring potential partnerships in connected TV (CTV) and other digital platforms to enhance advertising capabilities.

They also remain open to future acquisitions, with a focus on strategic alignment and maintaining profitability.

Affle India was granted another patent in the US just recently. This patent subject area is computer implemented method for partner pixelling for user identification, aimed at optimizing user identification for digital advertising.

What Lies Ahead?

As part of its expansion plans, Affle India is entering global markets and targeting premium segment.

Here are some growth levers that should be pointed out –

#1 Targeting Premium Users: Affle has been investing in developing new product use cases and forming partnerships to access premium ad spaces on connected devices like Apple’s SKAdNetwork (SKAN), the iOS App Store, and global OEM collaborations, as well as Connected TV (CTV), which typically command higher ad prices. Additionally, the company has access to premium Android devices costing over ₹60,000. Users of these high-end devices are more likely to spend on premium products and services, making these inventories valuable.

#2 Entering Developed Markets: The company is focused on expanding its footprint into developed markets where it is positioning itself as an ad-tech company delivering premium users and high-value conversions, potentially boosting CPCU rates. In the US, its largest developed market presence, it offers a fully integrated platform with multiple touchpoints for advertisers including CTV, which further enhances its conversion efficacy.

#3 Expanding via Acquisitions: Affle follows a Buy vs. Build approach while acquiring the businesses. This involves a careful assessment of whether to develop a capability internally or accelerate growth by acquiring companies with the desired technology and market presence. The management of the company has always said that their growth shall be driven by organic as well as inorganic measures and they are always looking out for opportunities to acquire companies that fit their value chain.

That being said, there are some threats that investors should take note of before investing in the stock…

Major privacy regulations and sudden changes can negatively affect its business.

Meanwhile, it also faces the risk of a slowdown… when a country’s economy worsens, advertising budgets are often among the first to be cut or slowed down, as Affle experienced with its fintech sector in the US in 2024.

Investors betting on Affle need to track how its different businesses scale, how it allocates capital to the new businesses, and whether digital ad lives up to the hype and continue its stellar performance.

Ultimately, you should carefully evaluate the company’s performance, valuations, and corporate governance before considering an investment.

How Affle India Share Price has Performed in the Past 1 Year

In the past 5 days, Affle share price has fallen 2%.

In a month, the stock is up 13%.

Affle has a 52-week high of ₹1,883 touched on 16 December 2024 and a 52-week low of ₹1,010 touched on 15 April 2024.

In the past 1 year, Affle India share price is up 45%.

Here’s a table comparing Affle with its peers

View Full Image

Happy Investing.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such.

This article is syndicated from Equitymaster.com