I have shares of Coal India bought at ₹406. What is the long-term outlook?

Vashista Chilkuri

Coal India (₹388): The stock has been consolidating between ₹350 and ₹410 since the beginning of this year within its broader downtrend. Resistance is at ₹420. The stock has to breach this resistance to indicate a trend reversal and turn bullish again. As long as the stock stays below ₹420, the downtrend will remain intact.

A fall to ₹330 looks likely in the coming months. Thereafter a fresh leg of upmove will have the potential to take Coal India share price up to ₹650-680 over the next couple of years. Since you are a long-term investor, accumulate at ₹350. Keep the stop-loss at ₹280. Revise the stop-loss up to ₹390 when the price goes up to ₹460. Move the stop-loss further up to ₹480 when the price touches ₹560. Exit the stock at ₹650.

What is the outlook for NTPC? Can I accumulate now?

Gopalakrishnan

NTPC (₹331): The stock has been in a strong downtrend since October last year. The bounce from the low of ₹292.70 made in February this year has failed to sustain. The stock is coming down again after touching a high of ₹371. That keeps the downtrend intact. Support is at ₹300-290. A break below ₹290 can drag NTPC share price down to ₹270-250 – an important support zone. We expect the downtrend to halt in this ₹270-250 support zone.

A bounce from this support region may have the potential to take NTPC share price up to ₹400-450 again. Since you have not mentioned your purchase price, it is difficult to give a precise advise. The ideal strategy to follow now will be to exit the stock now at current levels. Buy again when the price fall to ₹270-250.

I would like to buy LTIMindtree. What is the outlook? Is it a good time to enter the stock?

Pooja, Patna

LTIMindtree (₹4,616): The fall below ₹4,800 in March this year has turned the outlook negative. Although the stock has bounced back well from the low of ₹3,841, there is a key resistance at ₹4,940 and then in the ₹5,300-5,500 region. A strong rise above ₹5,500 is needed now to turn the outlook bullish for a rise to ₹7,000 again.

A reversal either from ₹4,940 itself or from the ₹5,300-5,500 resistance zone can drag the LTIMindtree share price down to ₹3,650-3,500 in the coming months. From a big picture, there is a big danger of the stock price tumbling towards ₹3,000-2,800 as long as it stays below ₹5,500. So, considering the danger of more downside risk, it is better to stay out of this stock now.

What is the outlook for Syngene International? Can I buy this stock now?

Liza Barik, Bengaluru

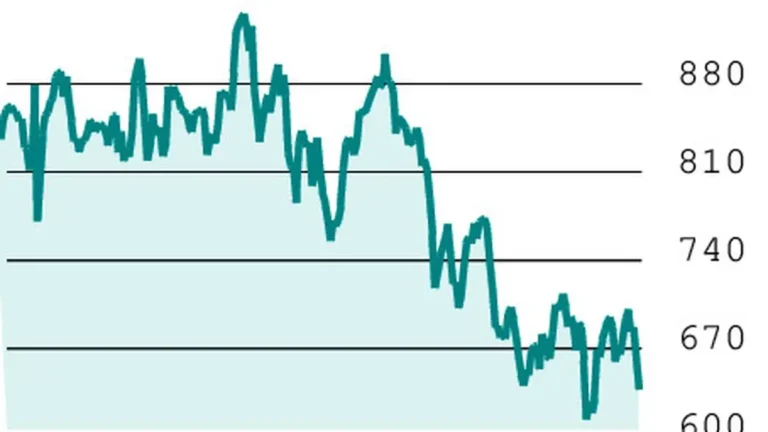

Syngene International (₹605): The stock is in a strong downtrend since December last year. There is room to fall more. Significant support is in the ₹560-530 region which can halt the current fall. A bounce from this support zone and a subsequent rise past ₹700 will confirm the trend reversal. From a long-term perspective, that will have the potential to take Syngene International share price up to ₹1,000-1,200 in a year or two. Wait for more fall.

Buy the stock at ₹570 and ₹540. Keep the stop-loss at ₹480. Trail the stop-loss up to ₹660 when the price goes up to ₹740. Move the stop-loss further up to ₹790 and ₹930 when the price touches ₹880 and ₹1,020 respectively. Exit the stock at ₹1,100. If the stock declines below ₹530, adhere to the stop-loss and exit.

Send your questions to techtrail@thehindu.co.in

Published on May 10, 2025