Sun Pharmaceutical Industries Ltd’s latest acquisition of US-based Checkpoint Therapeutics, Inc. is good news for its speciality business–an area of focus. Checkpoint is an immunotherapy and targeted oncology company. The move will help Sun Pharma expand its portfolio of products for skin cancer within the speciality business.

The key product owned by Checkpoint is Unloxcyt, a drug used to treat cutaneous squamous cell carcinoma (cSCC), a type of skin cancer, approved by the US FDA in December but still to be commercialised. The product can be expected to form the basis of products for other types of cancers as well.

“Unloxcyt (Cosibelimab; skin cancer) will complement its existing speciality products like Odomzo (sonidegib) and Yonsa (Abiraterone acetate) – both approved in the US, Nidlegy (awaiting approval in the EU), and the recently-acquired Fibromun (under Phase III),” wrote HDFC Securities’ analysts in a 10 March report. “The acquisition of Checkpoint is in line with Sun Pharma’s capital allocation strategy to strengthen its speciality business, with a focus on dermatology, ophthalmology, and oncology,” added HDFC.

Checkpoint adds a new growth lever in Sun Pharma’s onco-dermatology segment, even as the acquisition is expected to impact earnings negatively in the initial years as the product is yet to be commercialized. The transaction is expected to close in the June quarter, paving the way for the product’s launch.

Unloxcyt has not been filed in non-US markets, giving Sun Pharma an opportunity to leverage its global presence. Plus, as per Checkpoint, ageing population and increased exposure to ultraviolent radiation leads to more cases of this type of cancer. Kotak Institutional Equities expects Unloxcyt to be at least a $500 million peak global sales opportunity for Sun Pharma, or about 8% of FY26 expected revenue. The company is also investing significantly in R&D and has a pipeline of seven new active substance undergoing clinical trials.

To be sure, the deal comes as a lifeline for the loss-making Checkpoint, which has significant investment in R&D but negligible revenue given the lack of a commercial product. Its net loss stood at $27.3 million in 9MCY24 and revenue at just $0.04 million.

The acquisition involves a cash payment of $355 million (about ₹3,000 crore) or $4.1 per share of Checkpoint, a premium of 66% over the last closing price before the announcement. The agreement entails an additional payment of $0.70 per share on theachievement of certain milestones related to the non-US market.

Also Read | PLI boost: Cancer patients can hope for affordable drugs in India

Chasing growth

With a net cash balance of about $3 billion, as of December 2024, Kotak’s analysts expect Sun to continue to be more aggressive in chasing speciality assets such as Otenaproxesul and Cosibelimab.

Over the past few years, Sun has been focussing on its speciality business, which has grown at 25% CAGR during FY20-24 and now accounts for 18% of consolidated revenue, almost double that in FY20. The contribution of the speciality business can be expected to rise further from these levels.

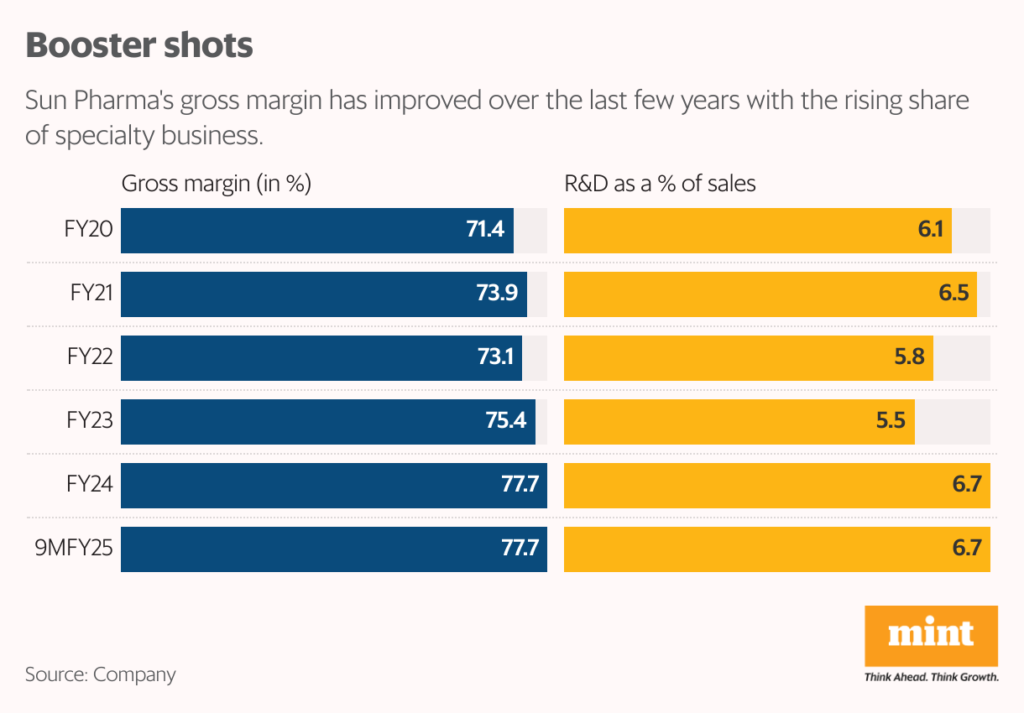

Note that Sun Pharma’s gross margin has improved to 77.7% in the first nine months of FY25 (9MFY25), up from 71.4% in FY20, aided by higher share of speciality business that fetches better margin than generic business, which is more commoditised in nature.

While Sun Pharma’s’s shares have gained about 4% since it announced the Checkpoint deal, the stock is down about 11% so far in 2025 amid trade measures being enforced by the US. Sun’s shares trade at 30 times its FY26 estimated earnings, as per Bloomberg consensus. A successful launch of the product is the need of the hour for the stock to gain further brownie points. On the flipside, a slower-than-expected ramp-up in the speciality business is a key threat.

Also Read: New introductions and price growth driving pharma market growth