N Kamakodi, MD & CEO of City Union Bank

City Union Bank has reported a 13 per cent increase in its net profit at ₹288 crore for the quarter ended March 31, 2025, compared with ₹255 crore in the year-ago quarter, aided by strong growth in operating profit.

The board has recommended a dividend of ₹2 per equity share (i.e., 200 per cent on the face value of ₹1 per equity share) for 2024–25. The old private sector bank’s operating profit rose 25 per cent to ₹441 crore — up from ₹352 crore in the year-ago quarter. This increase was driven by a 10 per cent boost in net interest income, which climbed to ₹601 crore from ₹547 crore in Q4 of FY24. “After restarting our business growth in this financial year, operating profit started improving,” according to a statement.

Interest income rose by 12 per cent to ₹1,533 crore in Q4FY25 compared to ₹1,374 crore in Q4FY24, while non-interest income surged by 43 per cent to ₹251 crore ( ₹175 crore).

The bank’s gross non-performing assets (GNPAs) decreased to 3.09 per cent during the March 2025 quarter, down from 3.99 per cent a year ago and 3.36 per cent in the December 2024 quarter. Net NPAs also declined to 1.25 per cent compared to 1.97 per cent in the same quarter last year and 1.42 per cent in Q3 of FY25.

Deposits increased by 14 per cent to ₹63,526 crore from ₹55,657 crore. The CASA (Current Account Savings Account) grew by 6 per cent to ₹18,119 crore — up from ₹17,050 crore. Advances rose 14 per cent reaching ₹53,066 crore compared to ₹46,481 crore. The CASA ratio constituted 29 per cent of total deposits.

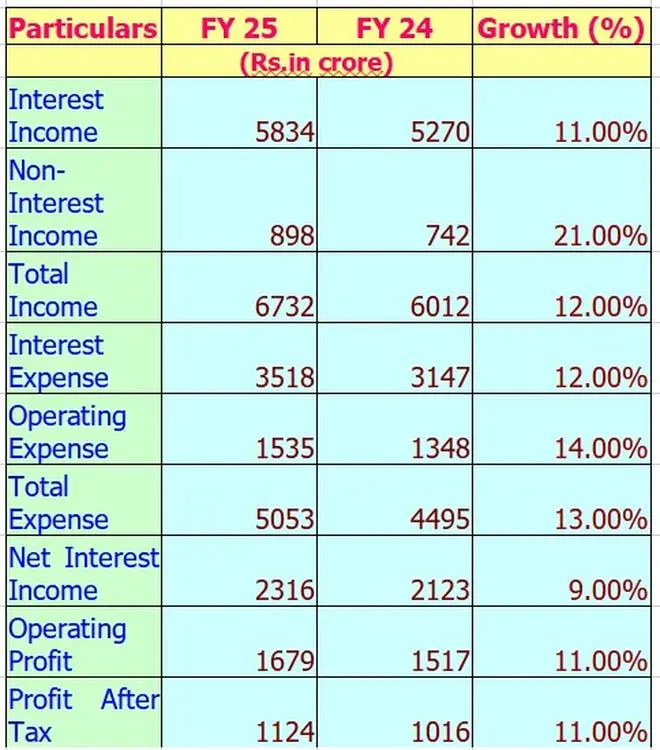

For the full year ended March 31, 2025, the bank’s net profit increased by 11 per cent to ₹1,124 crore — up from ₹1,016 crore in FY24. Interest income rose 11 per cent to ₹5,834 crore compared to ₹5,270 crore in FY24.

Among the total gross advances of ₹53,066 crore, loans to major industries accounted for 26 per cent, with the remaining portion distributed among categories such as agriculture, trade, services, and gold loans. The cost of deposits increased to 5.85 per cent in FY25, compared to 5.59 per cent in FY24, while the yield on advances rose to 9.79 per cent, up from 9.72 per cent.

Published on May 2, 2025