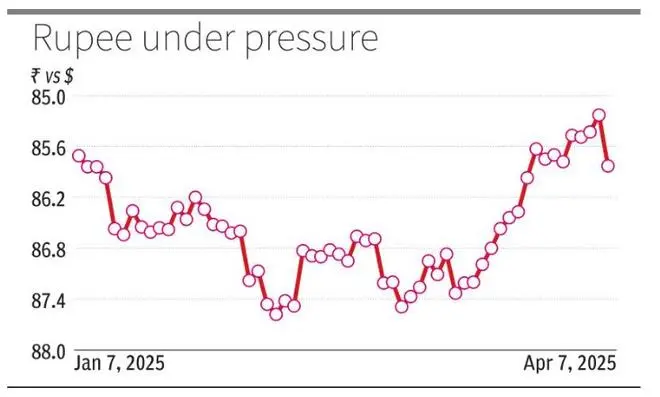

The rupee closed at 85.8350 per US dollar against the previous close of 85.2350.

| Photo Credit:

LeoWolfert

The rupee dropped 60 paise, its steepest single day fall in about three months, to end at a two-week low as US President Donald Trump’s reciprocal tariffs singed global financial markets, including Indian equity markets.

The Indian unit came under pressure as FPIs hit the sell button in the domestic equity markets amidst sell-off in the global markets. Foreign (custodial) banks bought dollars on FPIs’ behalf for remitting the sale proceeds.

Some respite

Falling crude oil prices and a weak dollar did little to prop up the rupee. It weakened due to heavy dollar demand from foreign banks’ FPI clients.

The rupee closed at 85.8350 per US dollar against the previous close of 85.2350. The rupee opened 35 paise down at 85.59, taking cues from the depreciating trend in the non-deliverable forward (NDF) market.

Arvind Kanagasabai, Executive Vice-President (Treasury), Tamilnad Mercantile Bank, said: “Whenever there is a huge crash in the market, money will go out by way of FPI outflows.

“All export-oriented companies shares have fallen today. What this indicates is that there will be shortfall in dollar inflows even as imports will continue. So, overall trade deficit will widen. Market players would have started covering based on this assessment. Hence, the rupee weakened.”

He observed that US importers will re-negotiate export contracts

Eyes on US Fed

Sankar Chakraborti, MD & CEO, Acuité Ratings & Research, said that if the US Federal Reserve proceeds with rate cuts, it could ease pressure on the rupee, giving the RBI more room for additional rate reductions.

Sonal Badhan, Economist, Bank of Baroda, observed that the current year is likely to be marked by a period of volatility on the currency front, awaiting clarity on US tariff policies. This will also set the stage for the Fed’s rate actions, in turn affecting how the dollar behaves.

On the domestic front, rupee is likely to find support from improvement in growth prospects, lower inflation and stable external deficits. Overall, BoB’s economics department expects the rupee to trade in the range of 85.5-87.5 in FY26.

More Like This

Published on April 7, 2025