RBI has flagged some concerns of excessive borrowing in unsecured segment and from derivative euphoria in the capital markets.

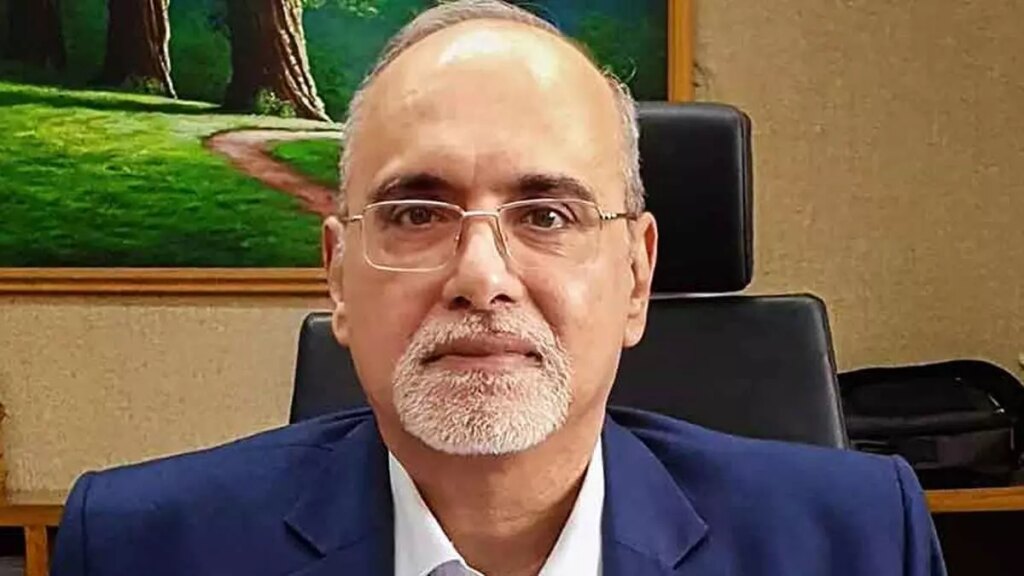

“The temptation of short-term gains can easily overshadow the long-term financial security of individuals,” RBI Deputy Governor M Rajeshwar Rao said at a BFSI summit jointly organised by IIM-K and NSE.

He emphasised that financial entities have a duty to ensure that customers fully understand the risks associated with leveraged products and speculative investing.

While RBI along with other financial sector regulators is taking progressive steps to educate the customers, financial sector entities also need to shoulder part of the responsibility, Rao said.

Absence of financial literacy leads people to fall prey to unscrupulous players which erodes the trust of the people in the system, he added.

While technology and digital innovations are driving financial inclusion and access, they also bring with them the risk of excessive exposure and over-leveraging, which can create significant vulnerabilities for both individuals and the broader financial system, cautioned Rao.

He noted that lenders must be aware of the risk of reckless financialisation.

“Increased financial literacy will help increase trust in the sector and its participants, whose benefits will accrue to the entities themselves,” he said.