Nirmala Sitharaman announced a major overhaul of the income tax system while outlining the Budget on Saturday. Individuals earning up to ₹12 lakh annually will no longer have to pay any tax under the new income tax regime — with benefit of ₹80,000. Sitharaman also proposed a change to the exemption limits and rejigged the tax slabs and rates across the board. The Finance Minister later revealed that it had been rather difficult to ‘convince the ministry, the boards’ even as Prime Minister Narendra Modi remained clear that he “wanted to do something”.

“I think the question should be how much did it take for me to convince the ministry, the boards… it is not so much the PM, the PM was very clear that he wants to do something. It is for ministry to have had the comfort level and then go with the proposal. So, the more work that was needed, was needed for convincing the board that efficiency in collection and honest taxpayers’ voice… all this was work here in the ministry, not so much for the PM,” she told PTI.

What did the Finance Minister tell Lok Sabha?

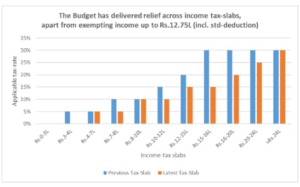

Sitharaman announced on Saturday that there would be “no income tax payable up to income of ₹12 lakh” under the new regime — other than special rate income such as capital gains. This limit will be ₹12.75 lakh for salaried tax payers due to standard deduction of ₹75,000.

“Slabs and rates are being changed across the board to benefit all taxpayers. The new structure will substantially reduce the taxes of the middle class and leave more money in their hands, boosting household consumption, savings and investment,” her Budget proposal added.

What are the new income tax slabs?

There will be no income tax levied on earnings below ₹4 lakh. Income between ₹4 lakh and ₹8 lakh will incur a 5% tax while the next slab — for salaries upto ₹12 lakh will have a 10% tax. A 20% tax will be levied on income between ₹16 lakh to ₹20 lakh. This will increase to 25% for earnings between ₹20 lakh and ₹24 lakh and further to 30% for income above ₹24 lakh.

(With inputs from agencies)