Even as the markets regulator took a slew of measures to curb the retail frenzy in options trading, it turns out that individuals participating only in the futures and options (F&O) segment of NSE comprise less than a fifth of those who traded in derivatives last fiscal.

The data implies that a significant portion of retail investors participating in the F&O segment have the experience of dealing in the equities cash segment. And, a small bunch trading only F&O may be the newer entrants looking to make quick gains.

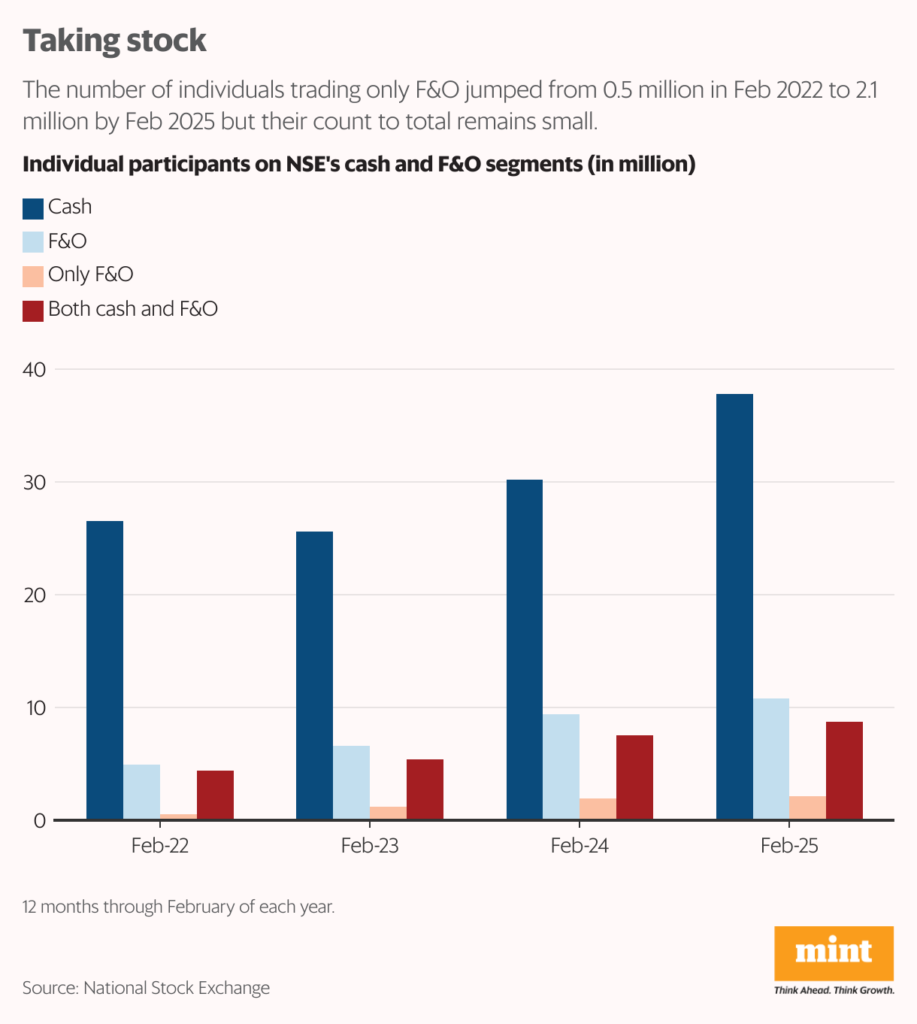

About 2.1 million traded solely in the F&O segment out of a total of 10.8 million individuals who participated in derivatives trading in 12 months through February 2025, shows NSE data. About 8.7 million who participated in the cash segment also traded on the derivatives segment, taking the total derivatives count to 10.8 million.

To be sure, the number of individuals trading only F&O jumped from 0.5 million in the year through February 2022 to 2.1 million in 12 months to February 2025.

Despite this surge, market stakeholders said, they are a tiny proportion of those trading both the cash and F&O segments, and could be newbies who entered in the past two to three years.

“The data implies that a majority of those trading on F&O have experience of trading in stocks,” said Alok Churiwala, managing director at the five-decade-old Churiwala Securities.

Also read | Sebi chief warns against “sledgehammer” regulation in complex F&O market

Sudhir Jha, EVP and head, digital revenue at 5paisa Capital, said, “Those trading only F&O are mainly newbies who entered the segment to make a quick buck from options trading, especially in the first half of the year when markets scaled a record high.”

The data also shows that 29.1 million individuals traded exclusively on the cash segment in the year through February 2025, while those trading both cash and derivatives stood at 8.7 million, taking the total of the cash segment to 37.8 million and the F&O segment to 10.8 million.

The NSE, which had a three-month rolling market share of 83% in equity options–based on premium turnover–defines individuals as individual domestic investors, non-resident Indians, sole proprietorship firms and Hindu undivided family (HUF) who have traded at least once in a year.

The total number of investors registered with NSE crossed the 11-crore mark in February. Other client categories include corporates, domestic institutional investors, foreign investors and proprietary traders.

Read this | NSE shrinks monthslong share transfer process to days ahead of a likely IPO

Concerned about the retail frenzy for weekly options trading on expiry day , the Securities and Exchange Board of India (Sebi) in October last year limited weekly expiries to one per exchange per week, from four expiries by NSE and two by BSE earlier; increased lot sizes of Nifty and Sensex contracts to ₹15-20 lakh from ₹5-10 lakh; and increased margins to trade on the expiry day, among others.

The combined impact of these measures caused the average daily premium turnover of index options on NSE to decline 18% to ₹44,427 crore in March from ₹54,127 crore in September last year when the Nifty hit a record high of 26,277.35.

“Since the (Sebi) curbs were enforced, there is some rationalisation in terms of the numbers of traders trading each month on F&O,” said 5paise Capital’s Jha. “The numbers, going forward, would depend on market reaction to global and domestic events such as trade wars, results and liquidity back home.”

And read | Sebi’s F&O followup: Enhanced risk metrics to curb manipulation fears