Domestic equity mutual funds have witnessed significant declines over the past five months, mirroring the downturn in equity markets. Persistent selling by Foreign Institutional Investors (FIIs), rising geopolitical tensions, market valuations, and subdued corporate earnings, has created an environment of uncertainty. This has led to a broad-based correction in equity mutual fund schemes, with some declining by as much as 30 per cent from their peak on September 26, 2024.

Schemes that adopted aggressive investment strategies, such as momentum investing and high-conviction bets, were particularly hard hit. Small-cap funds were the most affected, among equity categories. For example, over the past five months, major mutual fund categories like large-cap, mid-cap, and flexi-cap funds delivered returns of -16 per cent, -19 per cent, and -17 per cent, respectively, while small-cap funds saw a sharper decline of -20 per cent.

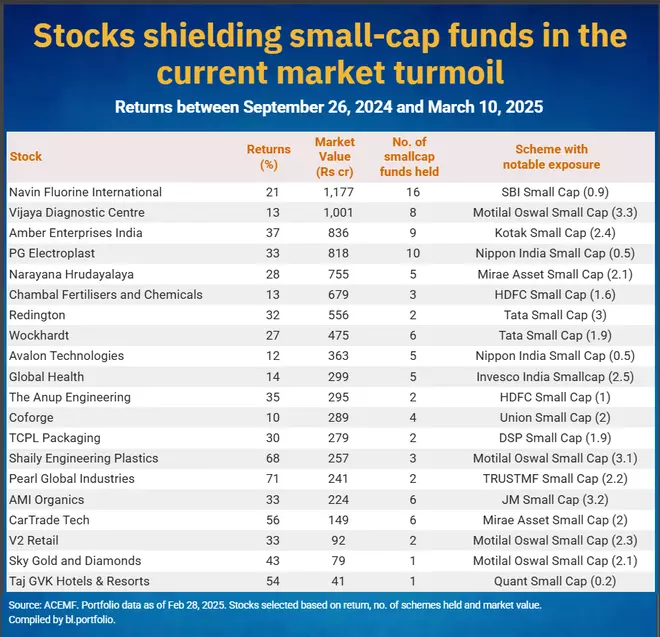

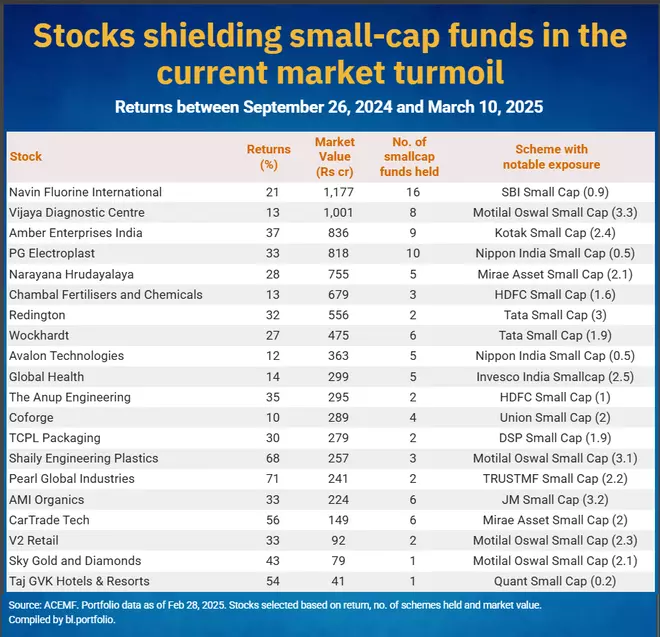

Stocks that delivered positive returns

Investors are shifting to safer stocks, lowering demand for riskier small-cap stocks. Stretched valuations and profit-booking have fueled the sell-off.

Nearly all the stocks in their portfolios significantly during this period. However, few stocks demonstrated resilience and managed to deliver positive returns over the last five months. Below is a list of such stocks held by small-cap funds that have bucked the trend and posted gains during this challenging phase.