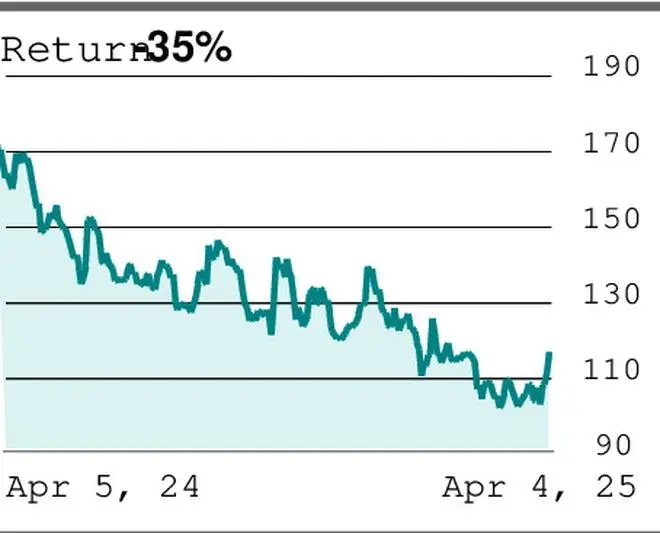

Gujarat Ambuja Exports (₹116.50)

Signs of trend reversal

Since mid-February, the stock of Gujarat Ambuja Exports has been charting a sideways trend. It was oscillating between ₹100 and ₹110. Prior to this, it saw a considerable downtrend which started from ₹208 in February last year. Now the stock seems to have reversed the trend upside after seeing a breakout of ₹110 last week.

Although ₹120 is a potential resistance, we expect the stock to surpass this and touch ₹150 in the medium-term. So, go long at ₹116 and buy more shares at ₹110. Place stop-loss at ₹97. When the stock rises to ₹130, alter the stop-loss to ₹110. When the stock hits ₹140, tighten the stop-loss further to ₹130. Liquidate the longs at ₹150.

Max Financial Services (₹1,165.35)

Strong upward momentum

The stock of Max Financial Services has been in a long-term uptrend. But it saw its price decline between November 2024 and February 2025. However, in early March, the stock found support at ₹975. On the back of this, the scrip rebounded strongly, posting five consecutive weekly gains. So, the momentum appears positive now.

Although there might be a dip to ₹1,060 from here, eventually, the stock is expected to rally to ₹1,400 over the medium-term. So, traders can buy at ₹1,165 and accumulate at ₹1,060. Keep a stop-loss at ₹930. When the stock rises to ₹1,300, revise the stop-loss to ₹1,200. On a rally to ₹1,350, tighten the stop-loss further to ₹1,280. Exit at ₹1,400.

Nestle India (₹2,261.45)

Chart shows accumulation

The stock of Nestle India, since November last year, has been oscillating in a sideways trend. It has been moving between ₹2,150 and ₹2,350. But notably, the stock managed to stay sideways even when the broader market was on a downtrend. This indicates relative strength and the price action hints at accumulation by smart money.

Moreover, a long-term trendline coincides at the base of the band. Hence, the probability of a rally is high. Buy at ₹2,260 and accumulate at ₹2,200. Initial stop-loss can be ₹2,080. Revise the stop-loss higher to ₹2,200 when the stock breaches ₹2,350. Raise the stop-loss to ₹2,500 when the stock hits ₹2,625. Book profits at ₹2,750.

Published on April 5, 2025