The inflow into equity mutual fund schemes plunged 26 per cent to ₹29,303 crore in February against ₹39,688 crore in January as the sharp fall in key benchmark markets rattled investor confidence.

The overall equity asset under management was also down about ₹2 lakh crore at 27.40 lakh crore (₹29.47 lakh crore), largely due to mark-to-market loss, according to the data from Association of Mutual Funds in India (AMFI).

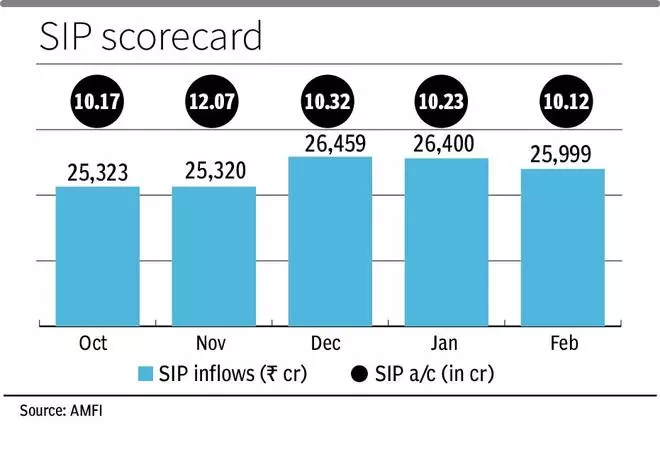

The SIP contribution was down to three-month low at ₹25,999 crore (₹26,400 crore) due to lower number of days in February.

The number of SIP accounts closed jumped sharply to 55 lakh against new accounts opened at 45 lakh.

Venkat Chalasani, Chief Executive, AMFI, said the industry has eliminated about 25 lakh SIP accounts after a reconciliation between the RTAs and exchanges.

This has resulted in the number of SIP outstanding accounts falling for the first time in recent years to 10.17 crore last month (10.26 crore), he said.

The SIP asset was down at ₹12.38 lakh crore (₹13.02 lakh crore) largely due to mark-to-market losses.

Inflows into all the equity funds except for focused fund were lower compared to January. Thematic and flexi-cap funds attracted the highest inflows of ₹5,711 crore (₹9,017 crore) and ₹5,104 crore (₹5,698 crore) while that of mid-cap and small-cap funds dipped to ₹3,406 crore (₹5,148 crore) and ₹3,722 crore (₹5,721 crore). The inflow into thematic funds was boosted by seven new fund offers collecting ₹2,072 crore.

Jatinder Pal Singh, CEO, ITI Mutual Fund, said the benchmark Sensex was down 5.5 per cent month on month due to multiple external factors primarily global trade tensions created by uncertainty on US tariffs.

Investor sentiment

Nehal Meshram, Senior Analyst – Manager Research, Morningstar Investment Research India, said while short-term headwinds have tempered investment flows, domestic investor confidence remains strong, as indicated by continued inflows.

Investors are adopting a cautious yet steady approach, reassessing their portfolios while maintaining long-term investment commitments, she said.

Dubbing it as a paradox of risk, Anand Vardarajan, Chief Business Officer, Tata Asset Management, said equity investors should remember that risk increases when markets rise and decreases when markets fall.

If not for the lesser number of days in February, he said the inflows through SIP would have been on par with January.