Equity benchmarks ended higher on Wednesday, with the Sensex settling at 81,330.56, up 182.34 points or 0.22 per cent, while the Nifty 50 gained 88.55 points or 0.36 per cent to close at 24,666.90. Metal stocks emerged as the day’s standout performers, with broader markets significantly outperforming benchmark indices.

Tata Steel led the gainers on the NSE, surging 3.93 per cent to close at ₹155.30, followed by Shriram Finance, which advanced 2.75 per cent to ₹651.00. Bharat Electronics Ltd (BEL) gained 2.61 per cent to ₹344.50, while Hindalco and Tech Mahindra rose 2.32 per cent and 2.22 per cent to close at ₹649.50 and ₹1,607.40, respectively.

On the losing side, Asian Paints was the top laggard, declining 1.66 per cent to ₹2,286.00. Cipla fell 1.33 per cent to ₹1,499.90, followed by Kotak Mahindra Bank, which dropped 1.12 per cent to ₹2,091.90. Tata Motors and Power Grid Corporation also ended in the red, declining 1.06 per cent and 0.72 per cent, respectively.

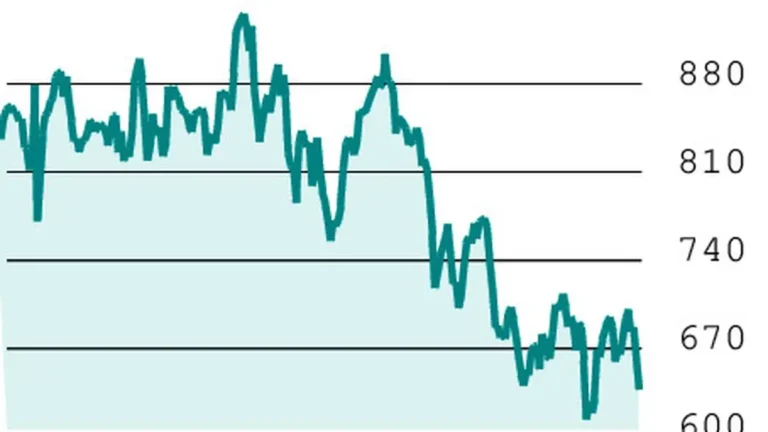

“It was a range-bound session for the benchmark index, which opened flat and remained within a narrow 150-point band,” said Rajesh Bhosale, Equity Technical Analyst at Angel One. “From a technical perspective, there’s been no major structural change, as prices continue to consolidate within the trading range of Monday’s strong bullish candle.”

The market breadth remained strongly positive for the third consecutive session, with 2,802 stocks advancing, against 1,181 declining on the BSE. The Nifty Midcap 100 and Smallcap 100 indices continued their outperformance, gaining 1.11 per cent and 1.44 per cent, respectively.

Barring banking stocks, most sectoral indices closed in the green, with the metal, realty, and IT sectors leading the rally. The Nifty Bank index declined 0.25 per cent to 54,801.30, while the Nifty Financial Services index dropped 0.23 per cent to 26,145.55.

The Indian Rupee strengthened by six paise against the US dollar, closing at 85.27. “Bolstered by a weaker US dollar index, cheaper imported commodities, and a prevailing risk-on mood in the markets, the Indian rupee gained against the US dollar today,” noted Dilip Parmar, Senior Research Analyst at HDFC Securities.

India’s retail inflation eased to 3.16 per cent in April 2025, its lowest level since July 2019, potentially setting the stage for rate cuts from the RBI. “Markets opened higher after domestic inflation data surprised positively, setting the stage for more rate cuts from the RBI in upcoming meetings,” said Satish Chandra Aluri from Lemonn Markets.

On the technical front, analysts maintain a cautiously optimistic outlook. “The index formed a small bull candle, which mostly remained enclosed inside the previous session price range, signaling consolidation after Monday’s strong upmove,” noted Bajaj Broking Research. “We expect the index to hold above the same and extend its uptrend toward 25,200-25,300.”

Looking ahead, the market is expected to continue its consolidation phase in the short term. “We believe this is a healthy pause in Nifty following Monday’s rally, and it may continue for another session or two,” said Ajit Mishra, SVP, Research, Religare Broking Ltd. “Traders should maintain a stock-specific approach and use this consolidation phase to accumulate fundamentally strong names.”

For Thursday’s trading session, key support for Nifty is seen at 24,500 and 24,378, while immediate resistance lies at 24,800 and 24,975, according to analysts. The volatility index, India VIX, decreased by 4.76 per cent, indicating reduced market volatility that could support a steady trend in the coming sessions.

Published on May 14, 2025