Out of the few stocks hovering near their lifetime highs in these volatile times, Marico is one and has stayed true to its defensive tag.

In the last five years, the stock delivered a return of 127 per cent, while in the last three years, it has returned 44 per cent. While the same is decent, and the stock has outperformed many FMCG peers, it has underperformed the Nifty 50‘s 166 per cent and 54 per cent respectively during the same periods.

Marico is currently trading at 51.4 times its FY26 earnings. This is at a 16 per cent premium to its five-year average and makes it a time to reassess risk-reward, especially after a brisk 20 per cent rally since March.

The acquired D2C stable being on the verge of operating profitability, growing salience of premium segments in the international segment and 95 per cent of Indian business gaining / sustaining market share, while 80 per cent of the business continued to gain / sustain penetration underline Marico’s strength amidst others.

All the while its premium valuation implies lower margins of safety, with performance in line with industry standards and not significantly superior to peers. And at its current valuation, against expected earnings CAGR of 15 per cent during FY25-27, the positives appear reasonably factored in. Given the balanced risk-reward scenario, while existing investors can continue to hold the stock, new investors will have to wait for better entry points.

The business

In FY25, 33 per cent of domestic revenue was raked in by the flagship product – Parachute coconut oil. Saffola edible oil and value-added hair oils (VAHO) contributed around 20 per cent each to the topline, while packaged foods’ contribution was at 8 per cent. Personal care portfolio contributed the rest.

Food segment’s (oats, honey, soya chunks etc) revenue for FY25 stood at 5x that of its FY20 levels. Leveraging Saffola’s brand equity, packaged foods business, especially oats, continued to grow in double-digits in FY25, as in FY24. New launches such as Musli and the recently-acquired True Elements have also been gaining traction.

Geographically, domestic business contributed around 75 per cent of revenue in the last two FYs, while international business raked in the rest.

Within international business, Bangladesh is the largest contributor, adding 40-45 per cent to the overseas revenue in. South-East Asia (20-25 per cent), Middle East and North Africa (MENA) (15 per cent) and South Africa (8-10 per cent) also contribute meaningfully. With the share of premium segment, within overseas revenue, improving from 20 per cent in FY21 to 29 per cent in FY25, the international business enjoys relatively-better operating margins.

Despite geopolitical tensions in Bangladesh, constant currency growth (CCG) came in at 12 per cent in FY25 year on year, continuing its double-digit CCG trajectory since FY22. MENA continued to be the fastest-growing market, as in the last two FYs.

General trade-heavy distribution

With respect to India business of Marico, general trade rakes in around 63-64 per cent of the company’s revenue and CSD (canteen stores department) brings in 6-7 per cent. Alternate channels, which include all other channels, are responsible for the rest.

The role of alternate channels, per Marico’s distribution strategy, is to drive premiumisation, upsizing and diversification. But interestingly, the profitability in general trade is better than alternate channels for Marico currently, while most other companies have it the other way round. With focus on tailoring SKUs (stock keeping units) by channels, individually, profitability should improve, especially in the quick commerce space as it improves the sell-through rate and reduces returns. SKUs are defined as different variants of a product differentiated with its size, colour, flavour or packaging.

Also, with the bulk of sales coming in from general trade, the company has been working on reviving this channel, focusing on rural outlet expansion. How the distribution channels add to the topline and bottomline, going forward, will be a key monitorable for the company, as for the industry.

Financial metrics

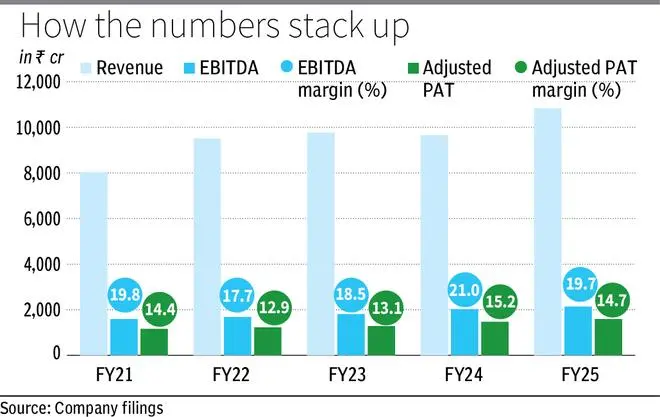

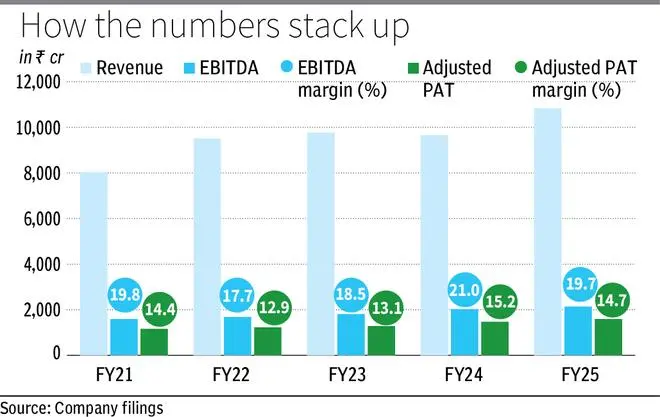

Revenue/ EBITDA/ PAT were up 12.2 per cent/ 5.6 per cent/ 9.7 per cent respectively year on year, in FY25.

The growth was backed by a 14 per cent revenue growth and 5 per cent volume growth in India business, while the international business saw an 8 per cent revenue growth (CCG of 14 per cent).

EBITDA margin for FY25 dropped 130 bps year on year and stood at 19.7 per cent, largely on account of input prices and advertising expenses as a percentage of revenue up 50 basis points (bps) each. But PAT margin was down just 50 bps mainly on account of lower interest costs.

Copra’s price was up 48 per cent (key material in coconut oil), while that of rice bran oil (key material in cooking oil) was up 25 per cent year on year, as of Q4 FY25. Advertising expenses stood elevated in line with the industry trends, aimed at brand building, increasing 18 per cent year on year, higher than the revenue growth.

What works

Digital-first brands – Beardo, Plix, True Elements and Just Herbs — are marginally negative in terms of operating profitability, but the management expects this segment to be at double-digit EBITDA levels come FY27. While True Elements and Just Herbs are expected to break even in the next 18-24 months, Beardo and Plix already EBITDA-positive in FY25 add substance to the claim. Q4 FY25 exit ARR (revenue from Q4, annualised) stood at ₹750 crore against ₹450 crore as of Q4 FY24, signalling healthy offtake.

Amidst demand concerns in mass-market segments, increasing salience of the relatively high-margin foods and premium personal care portfolio bodes well for Marico. Revenue contribution is up from 11 per cent in FY22 to 22 per cent in FY25, while the net contribution is 5x from FY22 levels. The strategy across segments is to hold market share in the mass segment and drive for growth in mid and premium segments

Softening input prices should help in gross margin recovery in FY26. But sustained increase in advertising expenses will dilute its translation into bottom-line growth. While the price growth on account of price hike measures in the recent quarters could drive revenue growth in the next two quarters, easing inflation and expected recovery in urban demand complimenting the rural resurgence could help volume growth from H2 FY26. A marginal 1 per cent decrease in volume in Parachute in Q4 FY25 despite a 30 per cent price hike, signals the flagship product’s resilience. Optimising SKUs should help improve profitability, going ahead.

But as briefed above, the premium valuation makes entry at current levels appear sub-optimal warranting a hold rating.

Published on May 10, 2025