India’s mutual fund industry is expected to see strong inflows of $40-45 billion in the financial year 2025-26, mainly driven by steady SIP (Systematic Investment Plan) contributions.

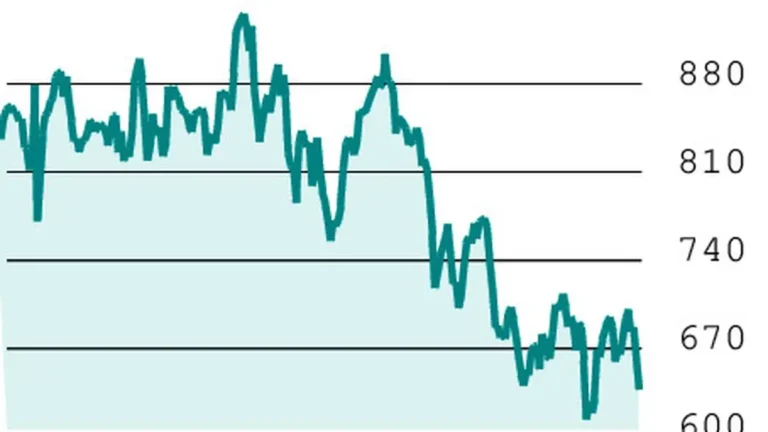

According to a report by Bernstein, this estimate is based on the April 2025 run-rate of $3 billion in monthly SIP flows. While the projected inflows are slightly lower than the record $55 billion seen in FY25, they remain significantly higher than FY24’s total of $30 billion and also above long-term averages.

It said “We think flows into mutual funds will remain resilient, at $40-45 Bn for FY26. We expect this to be driven by SIP money”.

India’s mutual fund industry, the report said, continues to benefit from disciplined retail investors who have shown steady commitment to SIPs, even during market corrections.

The report noted that although inflows were weaker on a month-on-month basis in the fourth quarter of FY25, they still beat expectations and remained strong in the face of a prolonged market correction.

Notably, actual flows were stronger than what was reflected in the performance of listed asset management stocks.

India’s mutual fund industry is also expected to see some lump-sum inflows in the second half of FY26, although the bulk of the inflows will likely come from SIPs.

The report believed this trend of consistent retail investments reduces the overall cyclicality of the business, which in turn supports a slightly higher valuation multiple for asset management companies.

India’s mutual fund industry, the report added, will likely see growth in assets under management (AuM) through a combination of inflows and modest mark-to-market gains over FY26-27.

However, these gains are expected to lag nominal GDP growth. At present, Bernstein maintains a preference for large-cap stocks when assigning estimates for mark-to-market gains in mutual fund AuM.

India’s mutual fund industry, according to the report, remains resilient and is set to support growth and valuation upside for asset management companies in the coming years.

Published on May 13, 2025