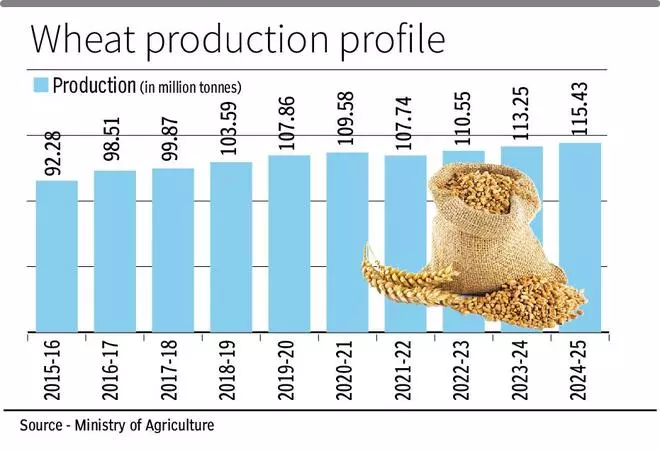

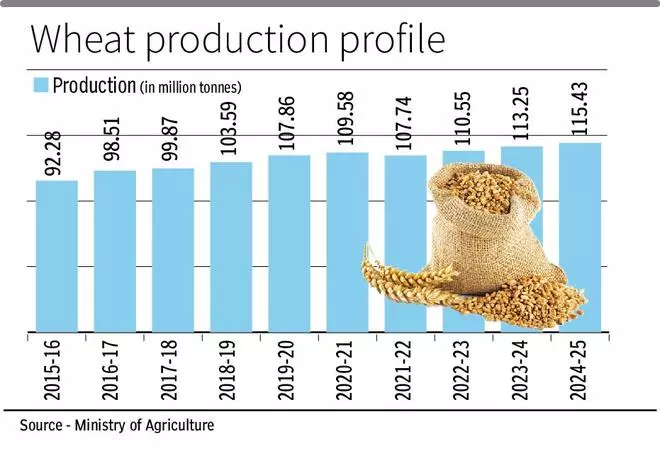

The wheat trade is not willing to accept the Ministry of Agriculture wheat production estimate this year of a record 115.43 million tonnes (mt), saying they are not convinced with the data.

They did not agree with the production survey of 110 mt, made on behalf of the Roller Flour Millers Federation of India (RFMFI), saying wheat output in 2025 may be in the range of 104-106 mt only.

The trade has not accepted the Ministry of Agriculture’s last year estimate of 113.25 mt either, while RFMFI projection was 105 mt. “We don’t accept the projections of RFMFI this year. We don’t agree with the Ministry of Agriculture’s forecast last and this year,” said a North Indian miller, who did not wish to be identified.

Supply pinch

“If the government projected a record 113.25 mt of wheat production in 2024, where are the stocks? We are feeling the pinch in supplies,” said a South India-based miller.

Sumit Gupta, CEO – Asia Business, McDonald Pelz Global Commodities, in a presentation at the wheat conclave in Goa last week, said a cross-section of traders pegged the wheat output at 82-105 mt and consumption at 85-98 mt.

Since 2023, when the wheat crop was affected by a heat wave, the trade and industry have been pegging the production lower, pointing to tight supplies. In 2023, the Centre estimated wheat production at 110.55 mt, but the trade contested the projection. It argued that the output was not higher than 100 mt. Even in 2024, a section of the trade pegged the production at around 100 mt.

Output flat

“Wheat production has plateaued and is not able to meet rising consumption,” said the South Indian miller. The wheat trade is questioning the basis on which the Centre had arrived at the production estimate.

A trade analyst shot back at the trade, questioning their source of estimate. “How does the trade estimate the crop is lower than the government estimate? What have they done to peg it lower?” the analyst wondered.

However, the analyst and trade are on the same page on consumption. “Consumption is some 9 mt a month. So, our annual consumption is now 108 mt. Has this been accounted for by the government?” the South Indian miller wondered.

The analyst concurred that wheat consumption is increasing with changes in food habits and living style. “Many in South India have begun consuming wheat instead of rice. They are eating more wheat products in hotels and restaurants,” he said.

Officials discount weather

Another North Indian miller said the crop quality has been affected in Punjab and Uttar Pradesh. The grain size has shrunk/shrivelled in these States, while the crop in Madhya Pradesh offers some promise.

Expressing scepticism over wheat production figures, another South India-based miller said this was mainly because of the India Meteorological Department projecting above-normal temperatures in March.

He said while consumption declined during the July-December 2024 period, the offtake was, however, increasing in the HoReCa (hotels, restaurant and catering) segment at a good pace.

Government officials are discounting weather-related problems as they say farmers have sown at least 70 per cent of climate-resilient wheat.

Yields hitting limit

McDonald’s Gupta said the volatility in wheat price, caused by fluctuating policies and global trends, needs to be carefully watched as small changes in temperature have a big impact on wheat production in India. “Also, overall yields are hitting the limit with limited potential to increase area,” he said.

He said wheat supply and distribution (S&D) in the country needs big production. Maintaining that import is a compulsive choice for the government, he said the S&D scenario in wheat, rice and maize is getting tighter due to the usage of 16 mt of grains in ethanol.

“Grain usage in ethanol last year was 9 mt. We need additional supplies of grains to cool off domestic inflation and increase availability,” he said in his presentation. The government will keep resisting imports to be self-sufficient. The country cannot handle any less /poor crop situation, and it has to be rebalanced with imports, he added.

March crucial

Stagnating production, increasing consumption and higher temperatures in growing areas during February and March are causes of concern to the wheat supply chain. The tight S&D scenario is likely to continue in wheat, Gupta said, adding that if the import duty is reduced to between 0 and 20 per cent, about 3-5 mt would be imported due to price parity and domestic.

The Centre should build buffer stocks for a timeframe of three-four years to take care of El Nino and La Nina weather cycles, he said. Import duty is currently used as a policy tool, and it creates uncertainty and barriers for Indian millers. Market-linked structure should be introduced, Gupta said.

“Anyhow, March is still a crucial period for output, procurement and imports,” the second North Indian miller said.

Ajay Kakra, Leader, Food and Agriculture, Forvis Mazars in India, said above-normal temperatures in March, following an already warm February, could affect the wheat crop. “Higher temperatures during the grain formation stage may negatively impact yields. A temperature rise could shrink wheat grains, reducing both quality and output,” he said.