New Delhi, Jul 10 (KNN) Indian banks are increasingly directing their lending activities toward micro, small and medium enterprises as large corporate borrowing continues to decline.

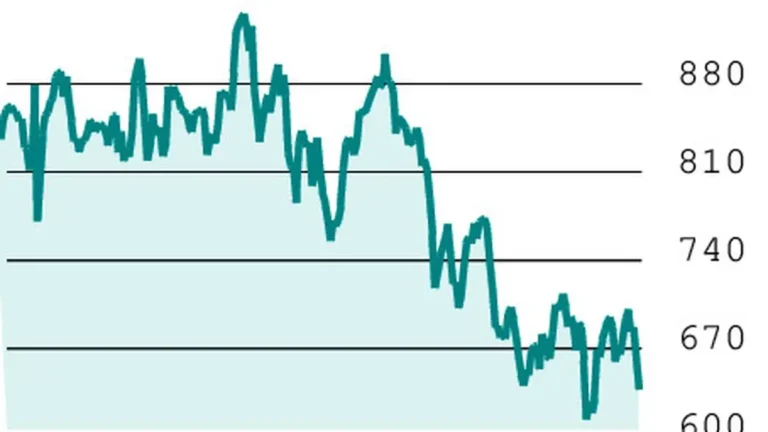

Recent data from the Reserve Bank of India indicates that MSME loans expanded by 4.4 percent to Rs 12.03 lakh crore over the past two months, while lending to large companies contracted by 3.8 percent to Rs 26.78 lakh crore during the same period.

The shift in lending patterns has become more pronounced in recent months, with bank loans to MSMEs reaching an eight-month high growth rate of 14.6 percent at the end of May.

This contrasts sharply with large corporate loans, which recorded modest growth of just 1 percent during the same timeframe.

Corporate entities have increasingly turned to alternative funding sources, with bond issuances reaching a record high of Rs 3.41 lakh crore during the April-June quarter, according to Prime database.

Commercial paper issuances also remained robust at Rs 4.50 lakh crore during the period, reflecting strong demand for market-based funding instruments.

The monetary policy environment has played a significant role in this shift, as a cumulative 100 basis point rate reduction since February has made bond market financing more attractive for corporate borrowers.

This reduction in borrowing costs through capital markets has diminished corporate reliance on traditional bank lending channels.

The MSME segment has simultaneously become more appealing to banks due to improving asset quality metrics.

The gross non-performing asset ratio for MSME portfolios declined to 3.6 percent in March 2025 from 4.5 percent in March 2024, according to the Reserve Bank of India’s latest Financial Stability Report.

This improvement in credit quality has enhanced the attractiveness of MSME lending for financial institutions seeking to maintain healthy loan portfolios.

(KNN Bureau)