India Infrastructure Finance Company Limited (IIFCL) plans to lay big focus green financing. It also feels that contrary to popular perception, private investors are coming in large ways. businessline caught up P.R. Jaishankar, Managing Director of IIFCL to talk about financial performance and future plans.

Your company has recorded its all-time high performance for the fifth year in a row, what are the reasons?

We put in place a strategy that worked well. We did the right things, and we kept doing the right things again and again, and tried to strive for excellence, that is the simple answer. As far as the risk management framework is concerned, we focused on qualitative, strategically , nationally important projects. We had put in concerted effort towards making our resources cost effective. We had a good resources and Treasury operation activities that ensured cost effectiveness in the financing that powered most of our efforts towards getting qualitative and strategically important projects in our business. We have put in place many financial products which are new and first time in the infrastructure sector. We have also tried to play a role of a policy advocate, towards directing and towards helping the direction of policy environment in the country. So, it’s a culmination of all these efforts that has made us more skilful towards making infrastructure financing more effective and more profitable.

What is the current status of infra financing?

So far, infrastructure financing in India is concerned, we have been relying heavily on banks and non-banking financial institutions. Today, the non-banking financial institutions have emerged as the largest lenders for infrastructure projects, with over 50 per cent of market share. In the completed and revenue earning project domain, we have the Infrastructure Investment Trust (InvITs) , which are actually helping to monetise projects and this activity is again creating liquidity for generating more new infrastructure projects. This is good development in recent times which is very useful initiative of the Finance Ministry, and we are seeing the advent of an era where a number of global investors are verykeen on investing in infrastructure sector, particularly in those areas where infrastructure projects have been completed, in revenue earning InvITs, and in the green field area. Take, for example, the Zurich International Airport, which is now in the Jewar Airport (Uttar Pradesh) and we have Alstom for railways. In the FII side, we have the Fairfax in Bengaluru airport and many others. In renewable energy, we are seeing so many investors coming in. The government has taken up a number of reforms. Concession clauses have been reformed. We have got InvITs, we have the HAM (Hybrid Annuity Model), we have the the insolvency board, we have now the arbitration and other conciliatory mechanisms. The time-consuming processes have been cut short, and now we are seeing a lot of improvement in these areas. Overall, the confidence of investors has definitely gone up, particularly in domestic private side which has led to global investors also recognising that and coming in a big way in India.

Government has consistently raised capital expenditure outlay in the budget and for the current fiscal it is ₹11.21 lakh crore, but we are not seeing the kind of response which it was expecting from the private sector. Where do you see the issue?

Globally green bonds have greeninium (Green Premium). However, today in India, we don’t have a premium. The regulatory requirements are still in the works. I’m sure we will see a number of initiatives by Reserve Bank and other regulators towards incentivising investors. The rating agencies have to get, put in place or shape certain methodologies to give certain incentives to and preference to green bonds. The market is still evolving. At this stage, it is too early to say that there’s no investors. As and when the regulations are in place, the methodologies of the rating agencies in place to incentivise investors, obviously, investors will come in. At the same time, we are looking at it more proactively, and we are looking at it in the long term. We like to put in place our strategy and our framework so that we are ready when the market evolves. There have to be processes for identification, verification and auditing the green assets, which is also happening at the same time. Therefore, we are seeing a whole ecosystem developing and still in one stage of evolution. It has been our concerted efforts to kind of put in place our green framework and strategies to catalyse the process.

Are you planning for an IPO?

We are growing, and growth requires resources, and resource plans are already there. When I have something very concrete, will definitely let you know.

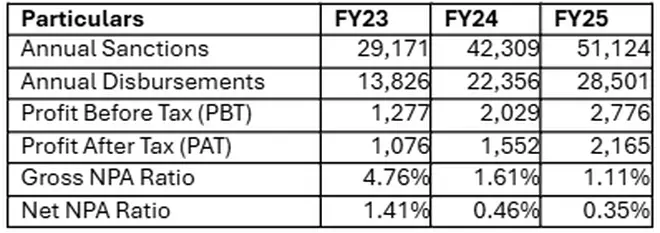

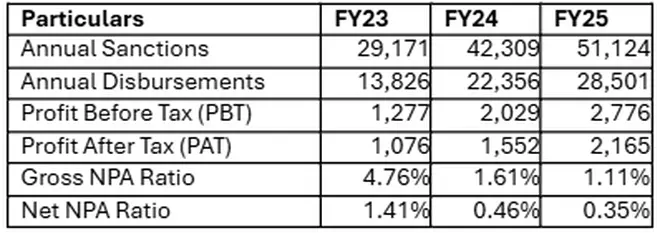

IIFCL’s Performance (Figures in Rs. Crore)