HDFC Bank reported particularly strong performance in retail loans and commercial and rural banking loans, which grew by approximately 9.0 per cent and 12.8 per cent respectively

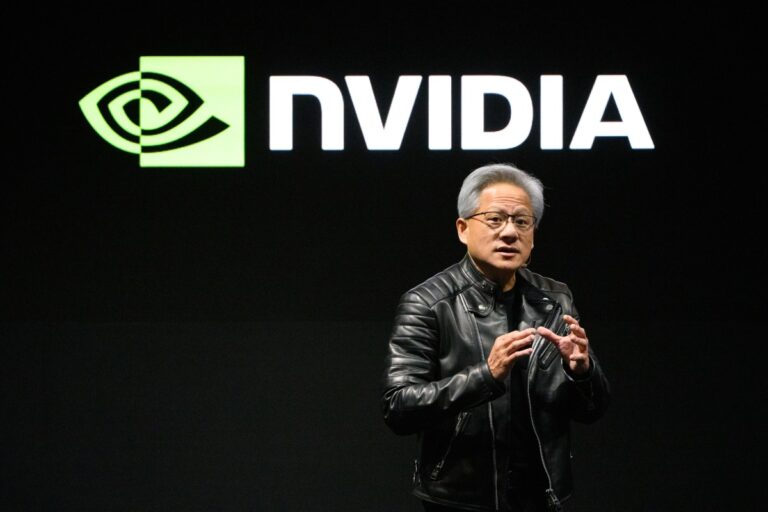

| Photo Credit:

SHAILESH ANDRADE

HDFC Bank shares climbed 1.74 per cent to ₹1,826.15 today, gaining ₹31.30 following yesterday’s disclosure of robust financial performance for the quarter ending March 31, 2025.

The bank reported impressive deposit growth of 14.1 per cent year-on-year, with total deposits reaching ₹27,14,500 crore as of March 31, 2025, up from ₹23,79,800 crore a year earlier. Period-end deposits also showed strong quarter-on-quarter growth of 5.9 per cent compared to December 2024.

HDFC Bank’s advances under management grew by 7.7 per cent year-on-year to ₹27,73,500 crore, while gross advances increased by 5.4 per cent to ₹26,43,500 crore compared to March 2024. The bank reported particularly strong performance in retail loans and commercial and rural banking loans, which grew by approximately 9.0 per cent and 12.8 per cent respectively.

Time deposits saw significant growth of 20.3 per cent year-on-year, reaching ₹17,70,000 crore, reflecting customer preference for these products in the current interest rate environment. CASA (Current Account Savings Account) deposits increased by 3.9 per cent year-on-year to ₹9,44,500 crore.

The bank also revealed it had securitised or assigned loans worth ₹10,700 crore during Q4 as part of a strategic initiative, bringing the fiscal year total to ₹57,000 crore.

The financial disclosure, filed with stock exchanges on April 3, noted that the full quarterly results will be subject to audit by the bank’s statutory auditors before final release.

More Like This

Published on April 4, 2025