HAL is targeting an order book worth up to ₹2.6 lakh crore for FY26, positioning the company for potential future growth despite the quarterly declines.

| Photo Credit:

MURALI KUMAR K

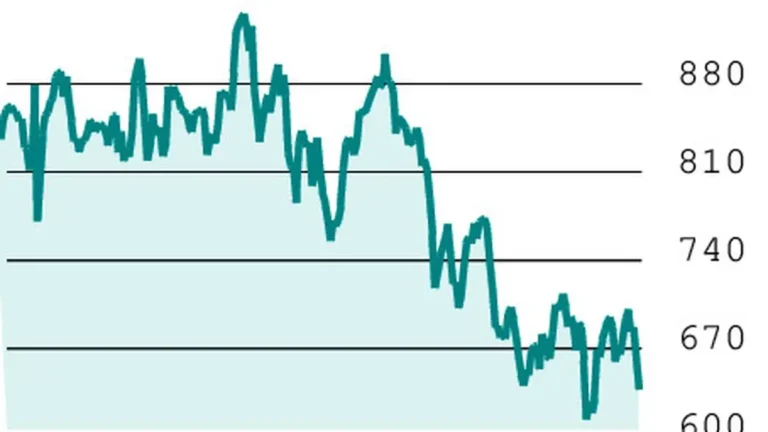

Hindustan Aeronautics Ltd (HAL) shares rose 1.51 per cent to ₹4,840 on Thursday after the State-run defence manufacturer reported better-than-expected quarterly results, despite posting declines in both profit and revenue.

The company’s consolidated net profit fell 7.71 per cent year-on-year to ₹3,976.66 crore for the quarter ending March 2025, surpassing analyst estimates of ₹2,592 crore. Revenue dropped 7.24 per cent to ₹13,699.85 crore, compared to the same period last year.

EBITDA for the quarter decreased by 10.2 per cent to ₹5,292 crore, but significantly exceeded expectations of ₹3,591 crore. The EBITDA margin stood at 38.6 per cent, well above the anticipated 27.6 per cent, though down by 140 basis points from the previous year.

For the full financial year 2025, HAL reported a 9.75 per cent increase in profit to ₹8,364.13 crore and a 2 per cent rise in revenue to ₹30,980.95 crore compared to FY24.

The defence manufacturer’s order book looks promising, with new manufacturing contracts worth ₹1.02 lakh crore and ROH contracts valued at ₹17,500 crore secured recently. Additionally, HAL signed a significant contract with the Ministry of Defence for 156 LCH Prachand helicopters worth ₹62,777 crore.

HAL is targeting an order book worth up to ₹2.6 lakh crore for FY26, positioning the company for potential future growth despite the quarterly declines.

More Like This

Published on May 15, 2025