Grammarly has secured a $1 billion commitment from General Catalyst. The 14-year-old writing assistant startup will use the new funds for its sales and marketing efforts, freeing up existing capital to make strategic acquisitions.

Unlike a traditional venture round, General Catalyst will not receive an equity stake in the company in return for the investment. Instead, Grammarly will repay the capital along with a fixed, capped percentage of revenue it generates from the use of General Catalyst’s funds.

The investment comes from General Catalyst’s Customer Value Fund (CVF), a capital pool that helps late-stage startups with predictable revenue streams deploy new funding specifically to growing their businesses. CVF’s alternative financing strategy essentially “lends” capital that is secured by a company’s recurring revenue.

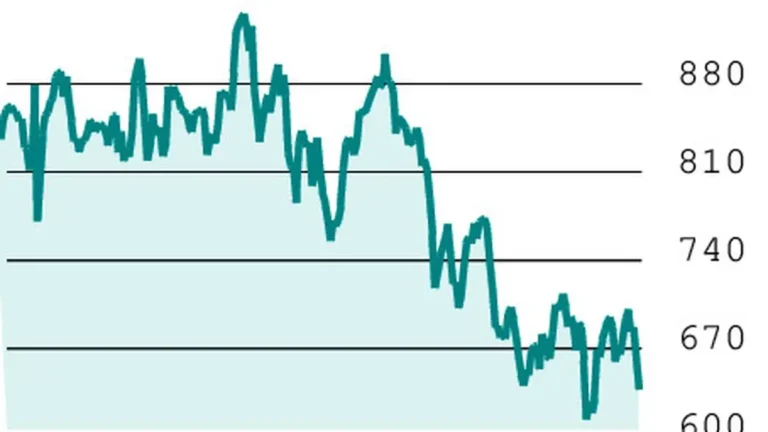

For companies like Grammarly, this form of financing is advantageous because it’s non-dilutive and does not reset the company’s valuation. Grammarly was valued at $13 billion in 2021, during the peak of the ZIRP era. However, the company’s valuation in today’s market is significantly lower, according to an investor in the company who asked to remain anonymous.

Grammarly didn’t immediately respond to a request for comment.

In December, Grammarly acquired productivity startup Coda and appointed its CEO, Shishir Mehrotra, to lead Grammarly. The company, which is evolving into an AI productivity tool following the acquisition, has annual revenue of over $700 million.

General Catalyst’s Customer Value Fund has provided funding to nearly 50 companies, including insurtech Lemonade and telehealth platform Ro. CVF maintains its own distinct limited partners and was not included in the firm’s recent $8 billion capital raise.

General Catalyst head honcho Hemant Taneja and Pranav Singhvi, co-head of CVF, talked with TechCrunch in greater length about the group’s specialized financing strategy last fall.