The Department of Investment and Public Asset Management (DIPAM) on Monday invited bids from merchant bankers to assist the government in its planned stake sale in public sector banks and financial institutions.

According to the request for proposal (RFP) floated by DIPAM, the merchant bankers would be empanelled for a period of three years (further extendable by one year). They will advise the government on the timing and modalities of the transactions for dilution of equities in select public sector banks and financial institutions.

DIPAM, which is under the Finance Ministry, manages government shareholding in public sector entities.

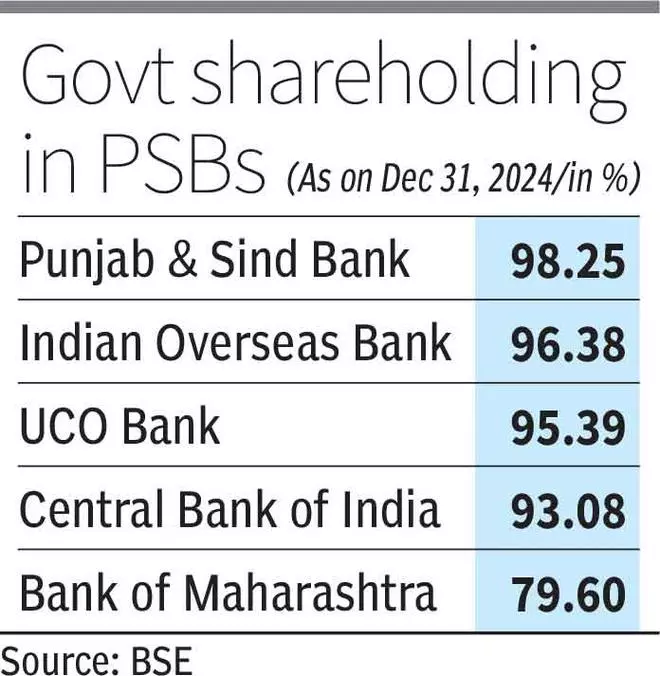

The Securities and Exchange Board of India norms prescribe a listed entity to have a minimum public shareholding of 25 per cent. It has granted time till August 1, 2026, to public sector banks to meet the norm. As on date, all the 12 public sector banks are listed. Five of them — Punjab & Sind Bank, Indian Overseas Bank, Uco Bank, Central Bank and Bank of Maharashtra — have minimum public shareholding of less than 25 per cent.

Among the public financial institutions, some equity in LIC could be diluted. As on date, the government holds 96.5 per cent stake in LIC. On December 20, 2023, the Department of Economic Affairs under the Ministry of Finance, had granted the Corporation a one-time exemption, allowing it to achieve 25 per cent MPS within 10 years from the date of listing — till May 2032 — in public interest. Further, on May 14, 2024, SEBI granted the Corporation three more years to achieve 10 per cent public shareholding — that is, within five years from the date of listing (till May 16, 2027).

Though the RFP to empanel Book Running Lead Managers (BRLMs)/Merchant Bankers-cum-Selling Brokers (MBSBs) and leading advisors has not mentioned the names of any entity for dilution of government’s stake, it seems that the government aims to adhere to the timeline for meeting the minimum public shareholding norms in select PSBs.

“The Government of India (GOI) intends to empanel BRLMs/MBSBs for a period of 3 years (further extendable by one year) in the context of dilution of GOI equity in select Public Sector Banks (PSBs), and select listed Public Financial Institutions (PFIs) (as defined under the Companies Act, 2013) using SEBI approved methods in accordance with the extant SEBI/RBI/IRDAI and Stock Exchanges Regulations/Guidelines,” the RFP said.

Two categories

The merchant bankers can apply for empanelment with DIPAM under two categories, depending on the capacity of the bidders in handling capital market transactions. There will be two categories of these empanelled entities — one for transaction size of equal to or greater than ₹2,500 crore and second for a transaction size of less than ₹2,500 crore.

The empanelled entities will advise the government on the timing and the modalities of the transaction for dilution of its stake in select public sector banks and public financial institutions using SEBI approved methods. They will prepare and submit the documents and structure the transactions. Beside these, they will also be responsible for conducting market surveys, domestic and international road shows to generate interest amongst prospective investors.

They will also be required to assist in the pricing of the transaction, allocation of shares and provide post transaction support, etc. “Ensure best returns to the Government. Ensure completion of all post issue related activities as laid down in the SEBI/RBI/IRDAI and other such Regulations, and NSE and/or BSE rules,” scope of work mentioned.

Bids can be submitted by March 27.