As India gains importance in global trade, investments and other financial transactions, its financial centres are rapidly ascending in global rankings. While Gift City has beendoing well in the rankings due to the backing it has received from the Centre, cities of Mumbai and Delhi are also rapidly improving their positions globally.

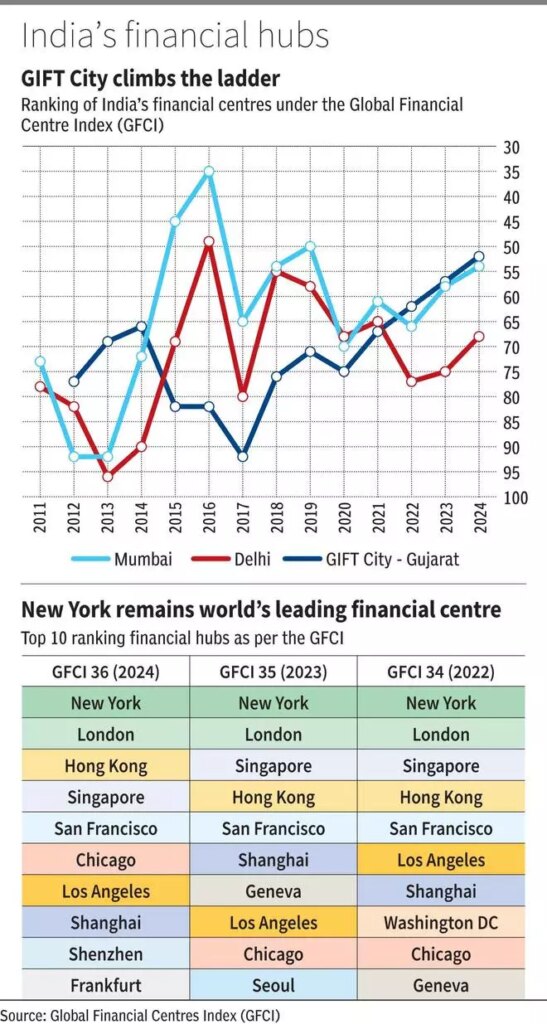

businessline’s analysis of the Global Financial Centres Index (GFCI) by London-based Z/Yen Partners in collaboration with the China Development Institute shows Gift City has improved its ranking from 77th in 2012 to 52nd position in 2024. Meanwhile, Mumbai’s position in the global leagues has improved from the 73rd rank in 2011 to the 54th position in 2024 with fluctuations in the interim years. Delhi has moved from 78th rank in 2011 to 68th in 2024.

GFCI ranks financial centres on the basis of over 29,000 professional assessments and more than 100 indices from World Bank and other sources.

GIFT City to the fore

Gift City was envisioned as India’s first smart financial hub to compete with global financial centres. It hosts the country’s first International Financial Services Centre (IFSC). IFSCs are designated zones that facilitate cross-border financial services, allowing transactions in foreign currencies and enabling international institutions to operate within India without regulatory constraints applicable to domestic markets.

Corporates setting up in Gift City benefit from a range of incentives, including a ten-year tax holiday on profits, and a streamlined regulatory framework under the International Financial Services Centres Authority (IFSCA). It also provides a conducive ecosystem for banking, insurance, asset management, and others looking to go global.

Other finance centres

Jaspreet Singh, Partner at Grant Thornton Bharat, said, “While Mumbai and Delhi are major financial centres, they face challenges such as regulatory complexities, infrastructure limitations, and political instability… Competition from other established financial hubs and the lack of a comprehensive innovation-driven ecosystem may hinder their upward mobility in global rankings.”

Experts also added that India’s financial landscape is expected to evolve further over the next decade. While Gift City is likely to consolidate its position, other cities such as Bengaluru and Hyderabad, with their strong tech and fintech ecosystems, could also emerge as new financial hubs. “As the government and industry players focus on building a robust financial infrastructure, these cities could contribute to a more diversified financial landscape,” Singh added.

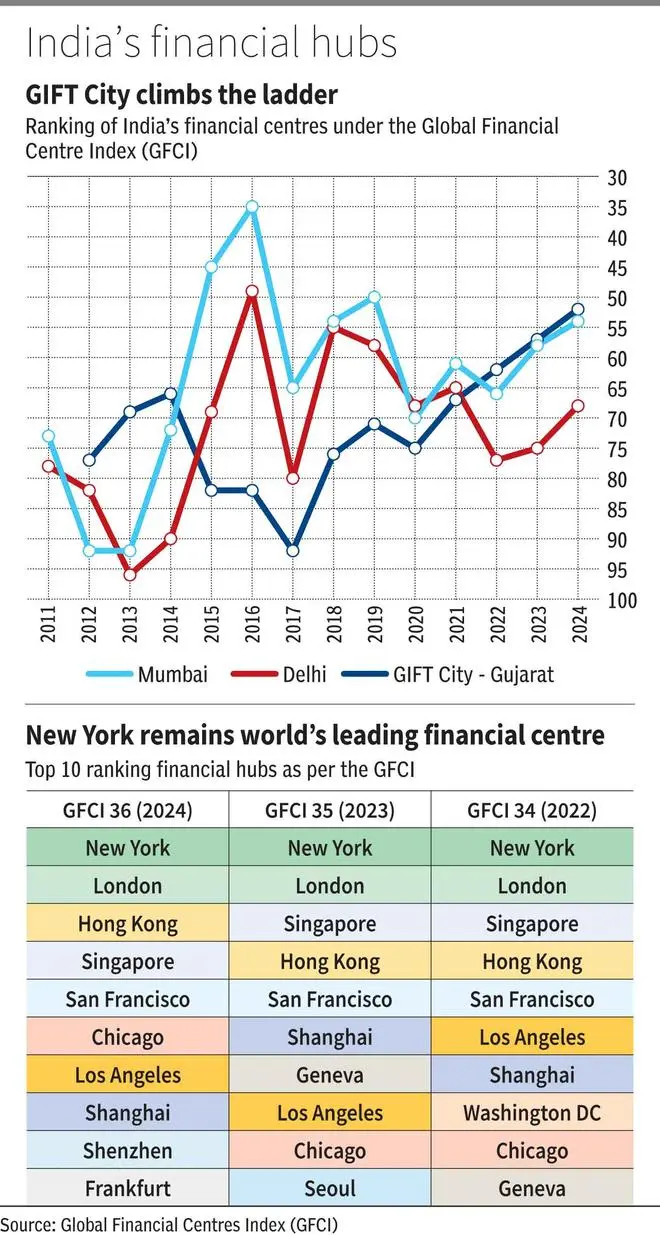

Globally, New York has remained unchallenged at the top, while cities like Singapore and Shanghai have gained ground, solidifying their positions as leading financial hubs. Hong Kong and Chicago climbed up to the 3rd position and 6th position from 4th and 9th in 2023, respectively.

The author is an intern with businessline