FPIs in India see ₹42.2 billion net inflow in April, with sectors like Financial Services and FMCG showing recovery.

| Photo Credit:

iStockphoto

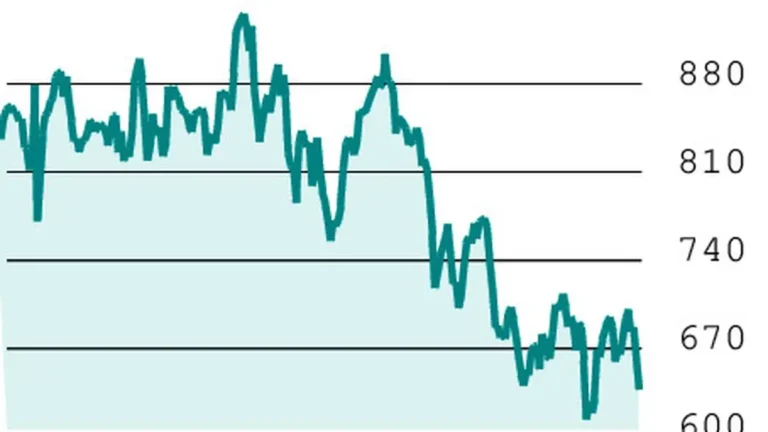

Foreign portfolio investors (FPIs) recorded a net inflow of ₹42.2 billion, witnessing a decline from ₹62.71 billion in March, according to the data compiled by IDBI Capital.

The FPIs inflow in financial services also dipped as in April, the sector attracted ₹184.1 billion, compared to ₹197 billion inflow in March. Media & Telecommunication maintained its momentum with ₹47.6 billion in inflows, reflecting sustained optimism around digital expansion and consumption.

Meanwhile, the fast-moving consumer goods (FMCG) sector staged a notable recovery, attracting ₹29.2 billion in April after witnessing outflows in March. Indian stock indices had seen upward movement since Trump’s decision to pause the reciprocal tariffs on dozens of countries, including India, for 90 days. The tariffs had initially set off a sell-off in equities globally, and India was no exception. Several reports attribute the trend to there being an easing seen in the input costs, and rural demand has witnessed an improvement.

The IDBI Capital data suggests that the Consumer Services and Diversified sectors also received modest inflows of ₹17.9 billion and ₹17.6 billion, respectively. However, inflows into Diversified were lower than the previous month, suggesting selective investor interest within that segment. Geopolitical tensions between India and Pakistan following the terrorist attack in Pahalgam on April 22, had weighed on investor of late. The investors will continue to keep an eye on the escalation of tensions between the two nations, as they bet in the financial markets.

On the downside, the IT & Services sector witnessed pressure due to the uncertainties globally and weakening tech spending by companies. The sector saw steep outflows of ₹154.1 billion–more than double the ₹74 billion outflow in March. Healthcare also saw a modest investor sentiment with outflow reaching ₹7.3 billion. The traditional sectors like automobiles, metals & mining, and real estate remained under pressure. In contrast, the power & utilities sector bucked the trend, with ₹9.2 billion in fresh investments. Overall, April’s positive FPI inflows were driven by Financial Services, Media & Telecom, and FMCG, despite significant outflows in IT, Automobiles, and Metals & Mining.

More Like This

Published on May 11, 2025