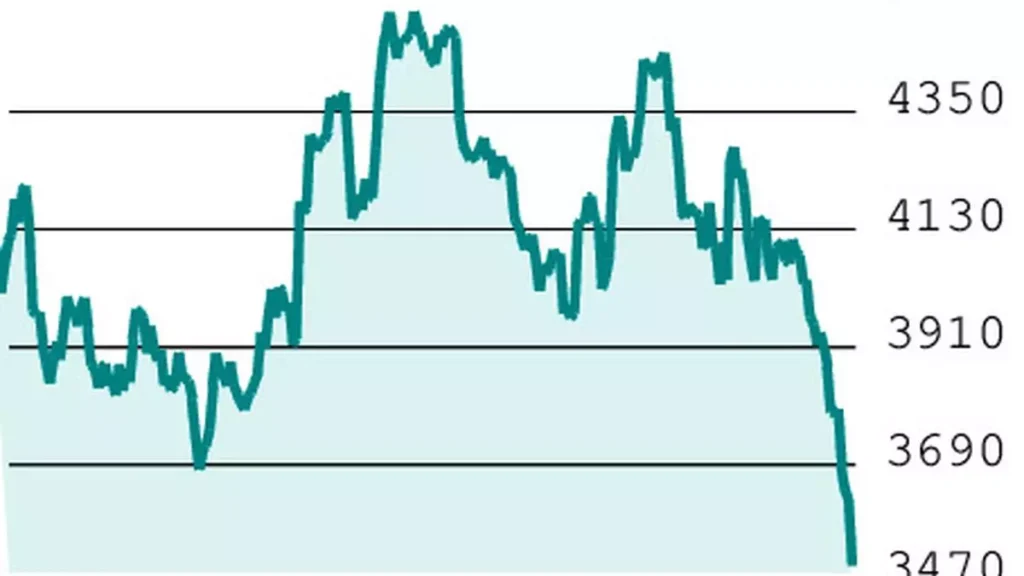

After a sharp fall, the stock of Tata Consultancy Services (TCS) (₹3,483.25) is ruling at a critical juncture. It finds an immediate support at ₹3,350 and a major one at ₹3,008. A close below the latter will alter the long-term bullish structure for TCS.

The stock finds an immediate resistance at ₹3,670. Only a close above ₹3,964 will arrest current bearish bias for the stock. But broadly, we expect the stock to move in a range with upward bias.

F&O pointers: TCS witnessed a rollover of nearly 95 per cent of the positions from February to March, which is much higher than the 3-month and 6-month averages of about 91-92 per cent.

Nevertheless, there seems to be some value buying as TCS March futures at ₹3,503.95 maintains a healthy premium over the spot price of ₹3,483.25.

Strategy: We advise traders to buy 3,500-call on TCS that closed with a premium of ₹82.80 on Friday. As the market lot is 175, this would cost traders ₹14,490. The maximum loss would be the premium paid (i.e., ₹14,490) which will happen if TCS fails to close above ₹3,500 on expiry. The break-even point is ₹3,582.80.

We advise traders to aim for an initial target of ₹150 for TCS 3500-call. Traders with higher risk appetite can set ₹200 as target. If the stock opens sharply lower, traders can stay away from this strategy.

Follow-up: Strategy on Tech Mahindra failed as the stock fell sharply and triggered the stop loss.

Note: The recommendations are based on technical analysis and F&O positions. There is a risk of loss in trading.