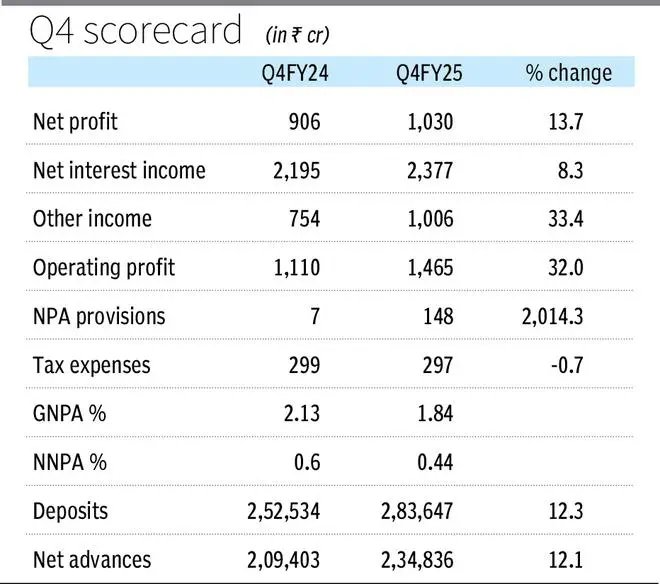

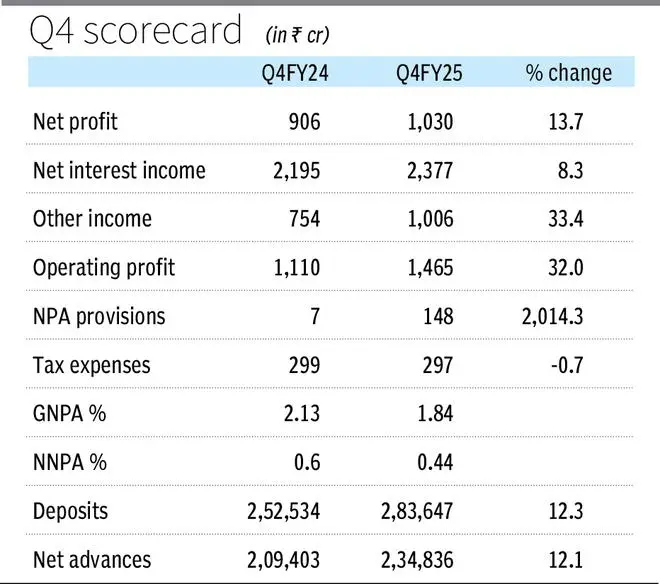

Federal Bank reported a 14 per cent year-on-year (y-o-y) increase in fourth quarter standalone net profit at ₹1,030 crore, supported by a moderate growth in net interest income and robust growth in other income.

The private sector bank logged a net profit of ₹906 crore in the year-ago period. The Bank’s Board recommended a final dividend of ₹1.20 per equity share of the face value of ₹2 each (60 per cent) for FY25.

Net interest income (difference between interest earned and interest expended) was up about 8 per cent y-o-y at ₹2,377 crore (₹2,195 crore in the year-ago quarter).

Other income, including fee-based income, treasury income and recovery in written-off accounts, rose 33 per cent y-o-y to ₹1,006 crore (₹754 crore).

Net interest margin (net interest income/ total assets) declined to 2.87 per cent (3.20 per cent). However, it saw an uptick of 19 basis points from 2.68 per cent in Q3FY25 despite the cut in repo rate.

NIM Management

KVS Manian, Managing Director & CEO, said, “Despite the prevailing rate cut environment, we have effectively navigated NIM pressures through strategic asset pricing, robust CASA growth, and the best asset quality seen in over a decade.

“Crossing the twin milestones of ₹5 lakh crore in total business and ₹4,000 crore in annual net profit marks a defining moment in our journey.”

Loan loss provisions jumped to ₹148 crore from ₹7 crore in the year ago quarter.

Asset boost

Gross non-performing assets (GNPAs) position improved to 1.84 per cent of gross advances as of March-end 2025 against 2.13 per cent as at March-end 2024. Net NPAs position too improved to 0.44 per cent of net advances from 0.60 per cent.

Gross advances increased by about 12 per cent y-o-y to ₹2,34,836 crore as of March-end 2025, with Commercial Vehicle/ Construction Equipment advances reporting the highest growth of 34.93 per cent, followed by Commercial Banking (26.76 per cent), Gold loans (20.93 per cent), Retail Advances (14.50 per cent), Business Banking (11.44 per cent) and Corporate Advances (8.39 per cent).

Total deposits rose about 12 per cent y-o-y to stand at ₹2,83,647 crore as at March-end 2025. The share of current account, savings account (CASA) deposits improved to 30.23 per cent in total deposits from 29.38 per cent.

Published on April 30, 2025