Negative market breadth

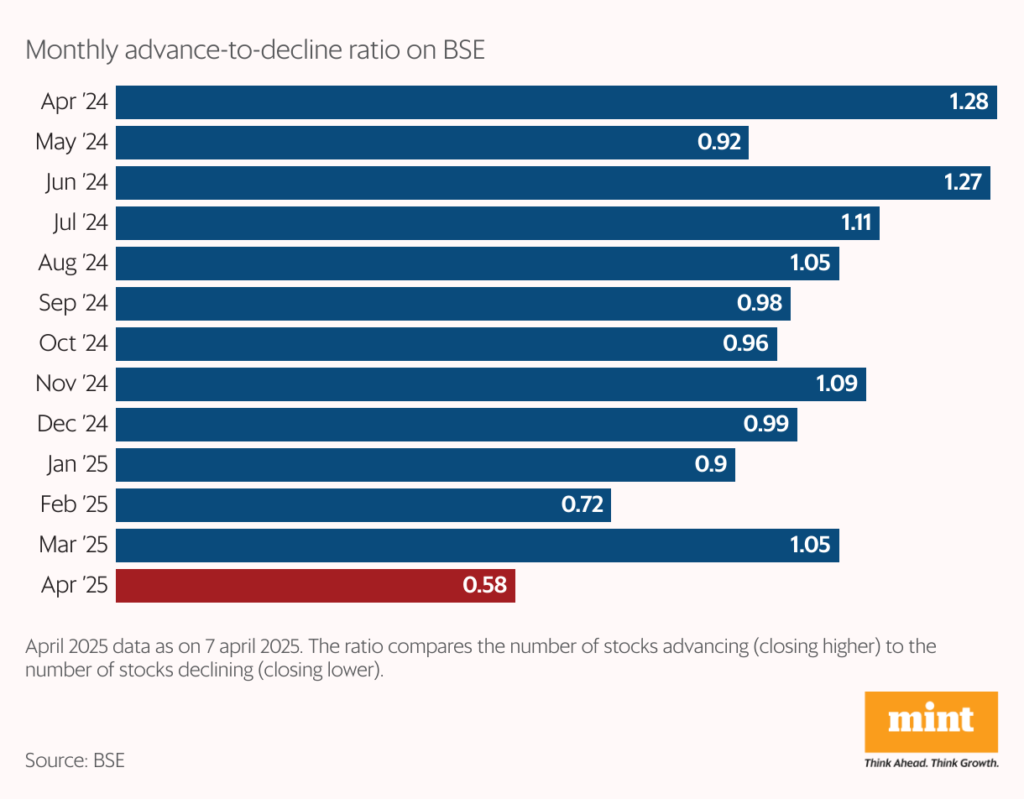

Indian equities also recorded their weakest market breadth in over a year on Monday, with the advance-decline ratio dropping to a concerning low of 0.62. This marks the worst monthly reading since at least April 2024, highlighting a broad-based weakness beneath the surface of benchmark indices.

The advance-decline ratio, a key gauge of market breadth, reflects the number of stocks rising for every one that declines. A ratio of 0.62 implies that for every 10 declining stocks, only about 6 managed to post gains—a clear signal of deteriorating investor sentiment and limited market participation in gains.

In comparison, the ratio, which stood at 1.28 in April last year, had moderated to 1.05 in March 2025. The sharp drop this month suggests that recent gains in frontline indices may be masking underlying weakness across broader segments of the market.

The paradox

Think market crashes are all doom and gloom? Mint’s analysis suggests otherwise—the best single-day rallies for the Nifty 50 Total Return Index have frequently occurred within days of its worst single-day collapses.

The takeaway for investors? The moments when the market feels utterly battered can, surprisingly, present the most fertile ground for significant gains.

Relative resilience

Moreover, India’s resilience relative to its global peers might offer further comfort to investors.

Since the announcements of reciprocal tariffs on 3 April (in Indian time), the Nifty 50 has fallen only 5% so far despite persistent foreign fund outflows, second only to Brazil’s Ibovespa index, which has fallen 3% (updated as on 4:30 pm IST). On Monday, the Nifty lost 742.85 points, or 3.24%.

The Nifty’s resilience stands in sharp contrast to steeper corrections elsewhere. Hong Kong’s Hang Seng has plunged 13.22%, Japan’s Nikkei 225 has declined 10.36%, Taiwan’s Taiex is down 9.7%, and the US S&P 500 has fallen 5.98% over the past three trading sessions.

The rupee’s resilience

As global currencies adjust to Trump’s tariff measures, several emerging market currencies have depreciated against the US dollar—potentially boosting export competitiveness. However, the Indian rupee has shown relative firmness, slipping just 0.47% between 3 April and 7 April.

The South African rand and Mexican peso have posted heavy corrections, depreciating by 3.23% and 3.26%, respectively, while the Brazilian real has weakened by 3.14%. The Chinese renminbi has declined by 0.59%.

On the flip side, some major currencies have moved against the broader trend. The Australian dollar appreciated sharply against the US dollar by 4.73%, followed by the British pound at 2.11%. The Swiss franc and the euro also strengthened by 0.59% and 0.80%, respectively—an outcome that could weigh on their export competitiveness in the short term.

Even so, the “intensifying trade war triggered by Trump’s tariff policy weighs on the INR”, said Kunal Sodhani, assistant general manager (vice president), global trading centre, FX & rates treasury, Shinhan Bank India.

“The heightened uncertainty has triggered risk-off sentiment, leading to outflows from emerging markets. DXY (US dollar index) also sharply bounced back above 103 levels, pushing USD higher against the majors,” Sodhani added.

“China also had retaliatory tariffs on the US. Thus, all eyes also remain on the USD-CNH (Chinese Yuan) pair. Any major weakening in the Chinese yuan can have its negative impact on rupee. For USD-INR, 85.20 acts as a good base while 86.50 levels may be tested.”