D-Street Ahead: Domestic equity benchmarks Sensex and Nifty 50 ended their week-long consolidation phase with a sharp ~3% decline, primarily driven by weak global cues. Concerns over the impact of US tariffs on global trade and persistent foreign fund outflows kept the sentiment negative from the outset.

Indian stock market’s performance last week

The broader and more domestically focussed mid-cap index confirmed a bear market, falling more than 20 per cent from its September 24 record close, pressured by poor earnings, lofty valuations, looming US tariff concerns and persistent foreign outflows. The small-cap index had confirmed the trend earlier.

In February, the mid-cap and small-cap indexes declined 11 per cent and 13 per cent, respectively, their worst monthly performance since the COVID-19 pandemic-induced selling in March 2020. Additionally, the Indian rupee depreciated 19 paise to close at 87.37 against the US dollar on Friday.

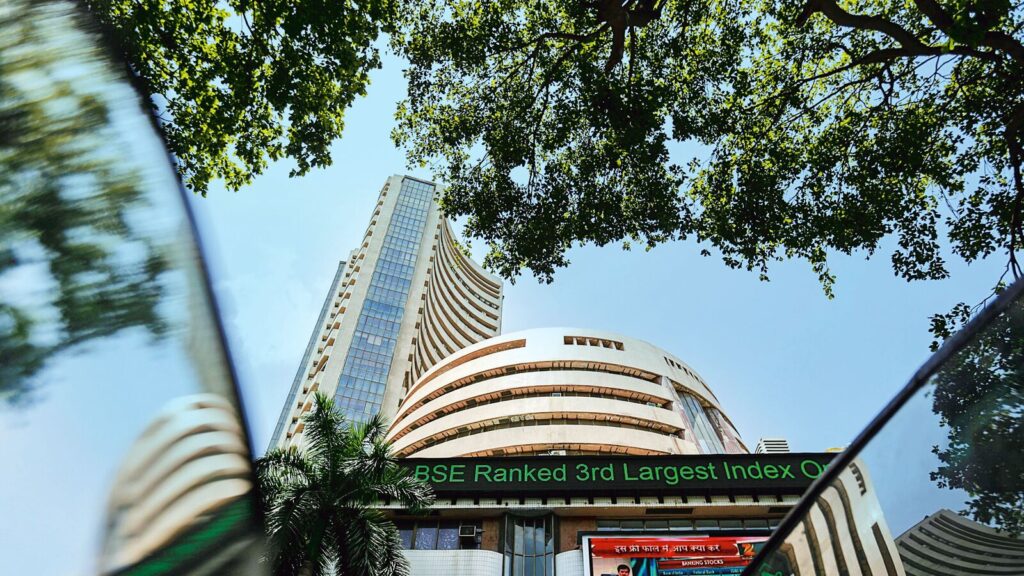

Following the sharp decline in equities, the market capitalisation of BSE-listed firms eroded by ₹9,08,798.67 crore to ₹3,84,01,411.86 crore ($4.39 trillion) on Friday. Their market cap has eroded by ₹93.91 lakh crore from last year September’s record high of ₹4,77,93,022.68 crore.

Sensex, Nifty, and Bank Nifty technical levels to watch

From a technical perspective, Nifty is approaching a crucial support zone of 21,800-22,000, where multiple indicators signal an important inflection point. A decisive break below this range could extend the decline toward the 21,000-21,200 zone, potentially pushing the index officially into a bear market.

On the upside, a rebound would face resistance in the 22,500-22,750 zone. Previously, we highlighted the importance of banking and IT sectors in shaping market direction. The steep correction in IT has validated this view, leaving the banking and financial sector as the key pillar of support. If the banking index fails to sustain above 47,500, it could also turn negative, adding further pressure on the markets.

D-Street trading strategy for next week

Ajit Mishra of Religare Broking Ltd maintains a negative outlook on Nifty until clear signs of reversal emerge. With sectoral declines occurring in rotation, only a few stocks show relative strength. “Traders and investors should exercise caution regarding stock selection and risk management, avoiding the temptation to average down loss-making positions or engage in bottom fishing, particularly in the midcap and small-cap segments,” said the D-Street expert.

According to Puneet Singhania, the overall trend remains weak, favouring a “sell on rise” approach. Any upward move may face resistance, reinforcing bearish sentiment in the near term. For Bank Nifty, the prevailing trend favours a “sell on rise” strategy, with any upward move likely facing resistance. Sustained weakness below support could accelerate downside momentum in the coming sessions.

THIS COPY IS BEING UPDATED

Disclaimer: The views and recommendations provided in this analysis are those of individual analysts or broking companies, not Mint. We strongly advise investors to consult with certified experts, consider individual risk tolerance, and conduct thorough research before making investment decisions, as market conditions can change rapidly, and individual circumstances may vary.

Catch all the Business News , Market News , Breaking News Events and Latest News Updates on Live Mint. Download The Mint News App to get Daily Market Updates.

MoreLess