Crude oil futures traded lower on Thursday morning after official data showed an increase in US inventories.

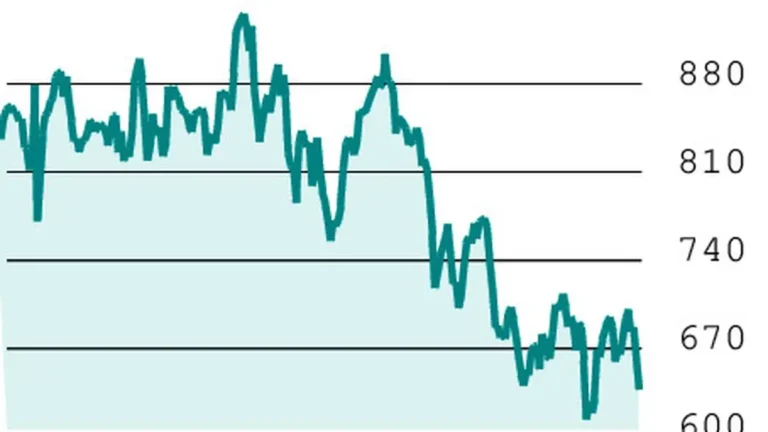

At 9.55 am on Thursday, July Brent oil futures were at $64.69, down by 2.12 per cent, and June crude oil futures on WTI (West Texas Intermediate) were at $61.77, down by 2.19 per cent. May crude oil futures were trading at ₹5,295 on Multi Commodity Exchange (MCX) during the initial hour of trading on Thursday against the previous close of ₹5,418, down by 2.27 per cent, and June futures were trading at ₹5,278 against the previous close of ₹5,401, down by 2.28 per cent.

Data released by the US EIA (Energy Information Administration) showed that the US commercial crude oil inventories increased by 3.5 million barrels for the week ending May 9. At 441.8 million barrels, US crude oil inventories were about 6 per cent below the five-year average for this time of year.

Total motor gasoline inventories decreased by 1 million barrels from last week and were about 3 per cent below the five-year average for this time of year. Finished gasoline inventories increased and blending components inventories decreased last week.

Total products supplied in the US over the last four-week period averaged 19.9 million barrels a day, down by 1.2 per cent from the same period last year. Over the past four weeks, motor gasoline product supplied averaged 9 million barrels a day, up by 3.8 per cent from the same period last year. Distillate fuel product supplied averaged 3.7 million barrels a day over the past four weeks, up by 1.4 per cent from the same period last year. Jet fuel product supplied was up 6.4 per cent compared with the same four-week period last year.

The prospects of an Iran-US nuclear deal also impacted the price of crude oil on Thursday morning. Referring to an interview published on NBC News, a Reuters report said Iran is willing to agree to a deal with the US in exchange for the lifting of economic sanctions.

Quoting Ali Shamkhani, an adviser to Iran’s Supreme Leader Ayatollah Ali Khamenei, the NBC News interview said Iran would commit to never making nuclear weapons, getting rid of its stockpiles of highly-enriched uranium, agree to only enrich uranium to the lower levels needed for civilian use, and allow international inspectors to supervise the process.

Any decision to lift sanctions on Iran would help increase crude oil supply to the global market.

Meanwhile, the Monthly Oil Market Report by OPEC (Organisation of the Petroleum Exporting Countries) trimmed the oil supply forecast for non-OPEC producers during the year. It said the supply from non-OPEC producers is forecast to grow by about 0.8 million barrels a day, year on year in 2025, revised down by about 0.1 million barrels a day from last month’s assessment. The main growth drivers are expected to be the US, Brazil, Canada, and Argentina. The supply growth forecast in 2026 from non-OPEC producers is also revised down by about 0.1 million barrels a day to reach 0.8 million barrels a day, with the US, Brazil, Canada, and Argentina as the key drivers.

May aluminium futures were trading at ₹243.40 on MCX during the initial hour of trading on Thursday against the previous close of ₹243.95, down by 0.23 per cent.

On the National Commodities and Derivatives Exchange (NCDEX), May jeera contracts were trading at ₹21,550 in the initial hour of trading on Thursday against the previous close of ₹21,655, down by 0.48 per cent.

June guarseed futures were trading at ₹5,140 on NCDEX in the initial hour of trading on Thursday against the previous close of ₹5,153, down by 0.25 per cent.

Published on May 15, 2025