More concerning is this has been tagged as a “structural slowdown,” caused by slowing government capital expenditure, weak manufacturing, sluggish exports, and lacklustre private investment.

Read this | Budget to offer blueprint of reforms under Modi 3.0

Naturally, expectations from the budget were sky-high, and the markets reflected this optimism, with the Nifty 50 breaching 23,600 ahead of the announcement. While the budget delivered on key fronts—tax reliefs to boost consumption and continued focus on rural support and emerging industries—its fragmented approach to infrastructure left some sectors underwhelmed. As a result, the broader Nifty 50 index remained flat on budget day.

Tax relief to revive consumption

At the heart of India’s growth troubles lies weak consumption demand.

Rural consumption has struggled for years due to erratic weather, while urban demand has been hit by persistent inflation and the fading of post-pandemic spending momentum. Given that private capex is unlikely to pick up without a surge in demand, the budget’s focus on tax reliefs was well-placed.

Read this | Budget 2025 | A ₹1 trillion largesse for India’s middle class

Finance minister Nirmala Sitharaman underlined this focus, stating, “A country is not just its soil; a country is its people.” And the much-anticipated tax reliefs followed.

View Full Image

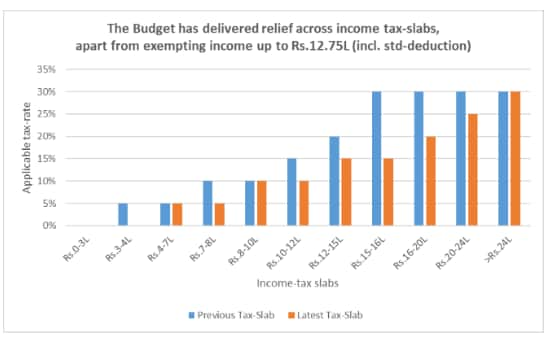

Under the new tax regime, salaried individuals earning up to ₹12.75 lakh will pay no tax, a sharp increase from the previous ₹7.75 lakh exemption limit. Higher tax brackets also saw relief, with the 30% tax rate now applicable on incomes above ₹24 lakh, up from ₹15 lakh.

Rural boost

The government has reinforced its commitment to rural demand in the 2025 budget, with a strong focus on agricultural resilience and self-sufficiency. A key highlight is the continued push for high-yield, climate-resistant seed varieties to combat climate change and water scarcity.

The newly announced PM Dhan Dhanya Krishi Yojana, launched in collaboration with states, aims to enhance agricultural productivity, promote crop diversity, improve irrigation, and expand credit financing. The initiative is set to benefit 1.7 crore farmers, ensuring that “migration is an option, not a necessity.”

Beyond this, the government has maintained its emphasis on reducing import dependence for key products like pulses, fruits, makhanas, and cotton through assured procurement schemes and the introduction of enhanced seed varieties. The export-driven seafood sector has also received targeted support. Additionally, credit-financing limits for farmers have been increased from ₹3 lakh to ₹5 lakh, further strengthening rural liquidity.

View Full Image

Market sentiment has reflected optimism, with the Nifty Rural Index gaining 0.7% on budget day.

Push for new-age industries, MSMEs

While private capex remains sluggish in traditional sectors, new-age industries have flourished due to sustained government backing. The latest budget continued this trend with a range of incentives.

AI (artificial intelligence) research has received a ₹500 crore boost through the Centre for Excellence in AI, while startups stand to benefit from an additional ₹10,000 crore infusion into the fund of funds.

Innovation is being fostered through Atal Tinkering Labs and PM research fellowship schemes. Clean-tech manufacturing, including solar PV cells, EV batteries, wind turbines, grid-scale batteries, and transmission mechanisms, has been prioritized.

The government has also set an ambitious 20 GW target for nuclear energy. To support renewable energy, duty exemptions have been granted on critical minerals such as cobalt and lithium, as well as on key components used in lithium-ion batteries and other renewable technologies.

In the electronics sector, domestic manufacturing will receive a boost through increased duties on finished products and reduced import duties on components. Meanwhile, gig workers on online platforms have been brought under the PM Jan Arogya Yojana, signaling an expanded social safety net.

The MSME sector, which contributes 36% to India’s manufacturing output and 45% to exports, has also received critical support. The government has revised classification criteria to bring more enterprises under the MSME umbrella, facilitating access to benefits. Under the credit guarantee cover for MSMEs, an additional ₹1.5 trillion in credit will be disbursed over the next five years. Export-focused SMEs will be eligible for term loans of up to ₹20 crore, while micro-enterprises registered on government portals will receive customized credit cards with limits of up to ₹5 lakh.

The budget’s emphasis on these sectors is timely and well-received. The market response underscores this confidence, with the Nifty SME Emerge Index reflecting strong sentiment and the Nifty India New Age Consumption Index surging 3% on budget day.

Fragmented support

Beyond new-age industries, the budget extended support to multiple sectors, though in a scattered manner. Manufacturing emerged as the biggest beneficiary under the enhanced Manufacturing Mission.

Specific sectors such as footwear and leather, toys, urban infrastructure, shipbuilding, and maritime industries have also been addressed. The travel sector has received targeted assistance, with a focus on regional connectivity through the UDAAN scheme and improved access to remote areas via helipad infrastructure.

Additionally, infrastructure as a whole has seen indirect support through the simplification of securities gains taxes applicable to Category-I and Category-II Alternative Investment Funds (AIFs), which channel investments into key focus sectors.

In the BFSI space, one of the most notable announcements is the increase in the foreign portfolio investment (FPI) limit for the insurance sector from 74% to 100%, though with conditions requiring premium reinvestment. Another key development is the introduction of the Grameen Credit Score, which aims to enhance transparency in the rapidly growing rural lending segment.

Despite these measures, the impact on the market has been lukewarm. The fragmented nature of the support has led to a subdued response, with the Nifty Infrastructure Index correcting by more than 1% and the Nifty Financial Services Index staying largely in line with the broader market, which remained flat on budget day.

Government capex slows, sops continue

A key concern was the slowdown in government capital expenditure.

Revised estimates indicate that the government’s capital expenditure for this fiscal year is expected to close at ₹10.18 lakh crore, falling more than 8% short of the budgeted ₹11.11 lakh crore.

Given that public spending has been the primary engine of economic growth since the pandemic, its diminishing returns were inevitable as avenues for additional capex became saturated.

With general elections this year, a slowdown in government-led investments was widely anticipated. While the budget outlines measures such as PPP proposals, asset monetization plans, and interest-free loans to states, the ability of government capex to drive growth from here on will likely be constrained.

At the same time, the budget continues to prioritize targeted welfare spending, reflecting the electoral success of such measures in state polls. The focus remains on women, youth, and marginalized communities, with incentives spanning food security, water access, healthcare, and education. While these initiatives serve essential social objectives, they lack the fiscal multiplier effect needed to significantly boost economic growth. The market’s response has been telling—on budget day, the Nifty Infrastructure Index corrected by over 1%.

To the government’s credit, though, fiscal discipline remains intact. The fiscal deficit for FY25 is now projected at 4.8% of GDP, slightly lower than the earlier estimate of 4.9%, with a further reduction to 4.4% targeted for the next fiscal year.

Also read | In economy’s shifting sands, a budget to boost demand

In an uncertain global environment where soaring deficits are becoming a concern in major economies, this commitment to fiscal prudence enhances India’s macroeconomic stability.

Ananya Roy is the founder of Credibull Capital, a SEBI-registered investment adviser. X: @ananyaroycfa

Views are personal and do not represent the stand of this publication.