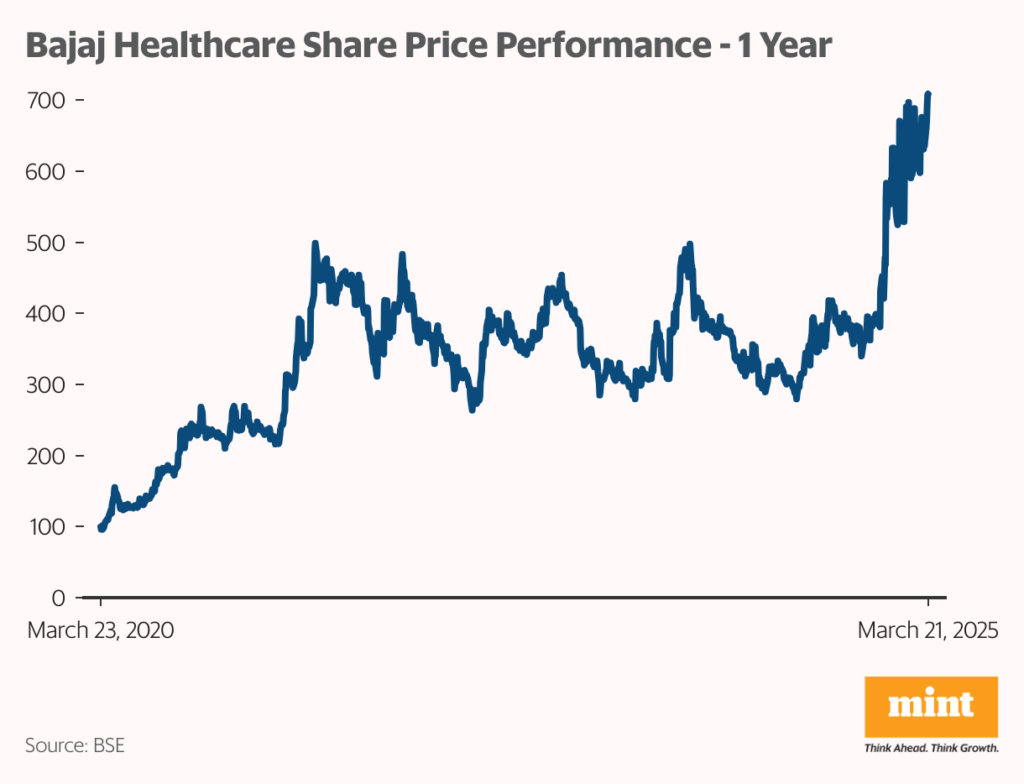

The optimism stems from a string of positive developments.

The company recently received regulatory approval to conduct Phase III clinical trials for Cenobamate, an advanced anti-seizure medication. It has also secured key international contracts, expanded its presence in the alkaloid manufacturing business, and is making aggressive moves in the magnesium segment. At the same time, it is taking steps to clean up its financials, selling assets to reduce debt and returning to profitability in FY25.

Read this | NLC India misses lignite target, but recovery plan sparks comeback hopes

But is this rally sustainable? While Bajaj Healthcare is making strides, its history of weak financials, mounting debt, and inconsistent performance casts a shadow over its recent success.

For clarity, Bajaj Healthcare is not affiliated with the Bajaj Group. The company was founded in 1993 by Sajankumar Bajaj and his family and later restructured as a closely held public limited company in 2005. While the promoters hold a 59.19% stake as of December 2024—down from 67.73% in June 2024—they recently bought shares worth ₹1.4 billion from the open market, signalling confidence in the company’s future.

With that distinction made, let’s break down the key factors driving the stock’s surge.

Clinical trials and expansion fuel optimism

The latest catalyst for Bajaj Healthcare’s stock is its entry into Phase III clinical trials for Cenobamate, a drug used to treat partial-onset seizures in adults. If successful, it could offer a much-needed treatment option for epilepsy patients in India, positioning the company as a key player in the neurology space.

Read this | Real alpha will still come from mid-caps and small-caps: TRUST Mutual Fund’s Mihir Vora

Beyond drug development, Bajaj Healthcare is also ramping up its global ambitions. The company secured Australia’s Therapeutic Goods Administration (TGA) approval for its Gujarat API site, allowing it to supply active pharmaceutical ingredients (APIs) directly to Australia and New Zealand. This regulatory green light strengthens its position as a global supplier and opens doors for more contract manufacturing deals.

Besides this, it recently received Drugs Controller General of India (DCGI) approval to manufacture Pimavanserin (34 mg capsule), an atypical antipsychotic for Parkinson’s disease psychosis.

Further, the company recently inked a contract for 15 APIs with UK and EU-based companies, following a similar deal earlier this year. These agreements reinforce its growing presence in international markets and could provide steady revenue streams.

Apart from its core pharmaceutical business, Bajaj Healthcare is diversifying its portfolio. It has completed the construction of an alkaloid manufacturing plant capable of processing 250 tonne of opium gum and 2,500 tonne of poppy straw annually. The company expects significant revenue growth from this segment, given the demand for opium-derived products in the pharmaceutical industry.

Additionally, Bajaj Healthcare has secured exclusive rights from Threotech LLC for the manufacturing, distribution, and sales of Magnesium L-Threonate (Magtein) in India. This foray into magnesium-based supplements could open up new opportunities in the nutraceuticals market.

The shadow of financial struggles

Despite these promising developments, Bajaj Healthcare’s financial track record remains a concern.

Read this | Varun Beverages battles pricing wars, ramps up on expansion to protect turf

Revenue has grown at a modest 5% CAGR over the past five years, and after a strong performance in FY20-FY22, the company struggled through FY23 and FY24, reporting declining revenues, shrinking profit margins, and even a loss in FY24.

The impact of these numbers was seen in the company’s return ratios. The company registered a negative return on equity (RoE) in FY24. The return on capital employed (RoE) also stood at an abysmal 1.88x.

The downturn was driven by falling exports, losses from discontinued operations, and a significant write-off of inventory acquired during COVID-19, which weighed heavily on its balance sheet. Additionally, interest expenses surged, further eroding profitability.

One of the biggest red flags in Bajaj Healthcare’s financials has been its rising debt burden.

Its debt-to-equity ratio increased to 1.19x in FY24, while its interest coverage ratio plummeted from 15.25x in FY21 to just 0.44x in FY24, signaling financial distress.

To address these issues, the company has taken steps to deleverage. It sold a plant in Tarapur to pay down part of its bank debt and is exploring the sale of other discontinued assets, with proceeds expected by the end of FY25.

Encouragingly, the company has posted profits for all three quarters of FY25 so far, reversing the losses recorded in FY24. After six consecutive quarters of declining revenue, a turnaround is finally taking shape.

However, the Bajaj Healthcare stock isn’t cheap.

It is currently trading at a price-to-book value (P/BV) ratio of 5x—an 86% premium over its historical average of 2.69x.

Also read | Nifty may face stiff resistance at 23600 this week

The company’s improving financial performance and global expansion justify some optimism, but given its checkered history, investors will be watching closely to see if it can sustain its momentum.

The bottom line

Bajaj Healthcare’s stock surge is driven by regulatory breakthroughs, global expansion, and improving financials. While the company has taken concrete steps to address its debt burden and return to profitability, its historical financial struggles cannot be overlooked.

For more such analyses, read Profit Pulse.

The key question for investors: Is this a lasting turnaround or just a temporary rebound?

About the author: Ayesha Shetty is a research analyst registered with the Securities and Exchange Board of India. She is a certified Financial Risk Manager (FRM) and is working toward the Chartered Financial Analyst (CFA) designation.

Disclosure: The author does not hold shares in any of the companies discussed. The views expressed are for informational purposes only and should not be considered investment advice. Readers should conduct their own research and consult a financial professional before making investment decisions.