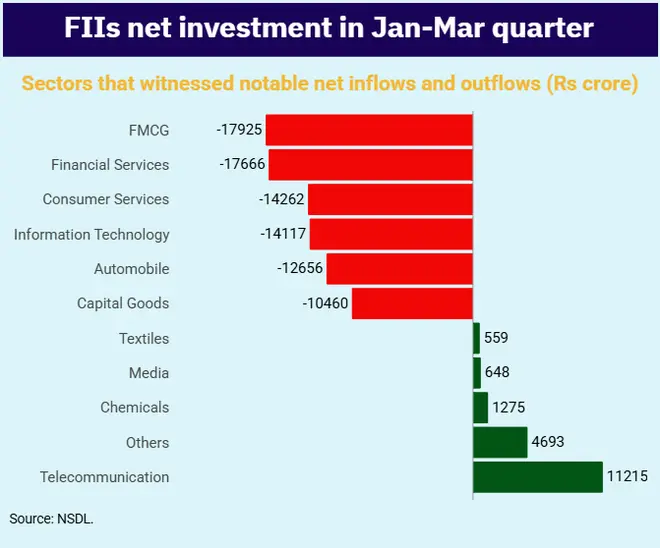

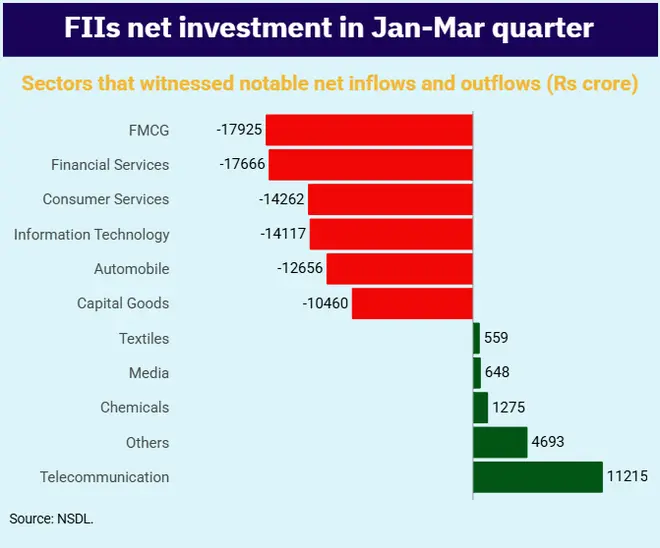

Foreign Institutional Investors (FIIs) significantly reduced their positions in FMCG, Financial Services, Consumer Services, and IT sectors during the January-March quarter of 2025, according to NSDL data. Conversely, Telecommunication, Chemicals, Media and Textiles sectors attracted net inflows from foreign investors during the same period.

Investment patterns from FIIs showed considerable volatility throughout the quarter. January and February witnessed substantial outflows of approximately ₹87,000 crore and ₹58,500 crore, respectively, continuing the trend from the December 2024 quarter when FIIs withdrew around ₹1.8 lakh crore. However, March marked a reversal with net inflows of ₹2,783 crore, as ACEMF data indicates.

Market experts attribute this late-quarter turnaround to several factors, including expectations of interest rate cuts, central bank liquidity support and recent regulatory reforms that doubled FPI investment thresholds for granular disclosures to ₹50,000 crore.

Notably, the second half of March saw notable sector-specific inflows, with Financial Services receiving ₹17,585 crore, Telecommunication attracting ₹3,413 crore and Healthcare gaining ₹2,138 crore in foreign investments. Meanwhile, Oil & Gas, IT and Consumer Services saw net-outflows of ₹2,449 crore, ₹1,517 crore and ₹1,158 crore, respectively.

Published on April 8, 2025