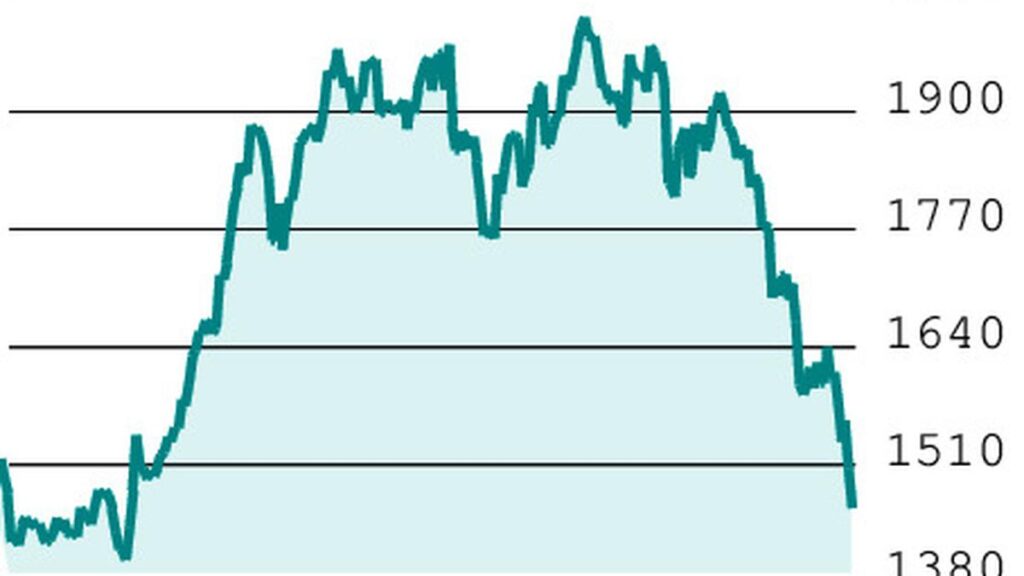

The short-term outlook for Infosys (₹1,451.65) remains bearish. Immediate supports are at ₹1,368 and ₹1,227. A close below the latter will alter the long-term outlook on the stock. In that event, the stock can fall to ₹1,060.

Nearest resistance is at ₹1,562. Only a close above ₹1,720 will trigger a fresh rally on the stock. We expect the stock to remain weak and volatile in the short term.

Events: The company will declare its results on April 17.

F&O pointer: Infosys futures (April) closed at ₹1,457.70 against the spot price of ₹1,451.65. The counter witnessed a steady build up in open positions despite the sharp fall it witnessed during the last one month. Option trading indicates that Infosys could move in the ₹1,360-1,700 range.

Strategy: Consider a long strangle using May contracts for better time value. Traders can buy 1600-call (₹19.35) and 1360-put (₹23.50) of May expiry. As the market lot is 400 shares, the strategy would cost ₹17,140. This would be the maximum loss which will happen if Infosys is stuck between the strike prices (i.e., ₹1,360 and ₹1,600).

If the stock either moves above ₹1,642.85 or dips below ₹1,317.15 on expiry, the position can turn profitable. Hold the trade for at least two weeks. Initial stop-loss can be ₹20. Traders can aim for a combined premium value of ₹75.

Follow-up: Hold Power Grid position for one more week and can reviewed later.

Note: The recommendations are based on technical analysis and F&O positions. There is a risk of loss in trading.

Published on April 5, 2025