Target: ₹1,315

CMP: ₹1,030.95

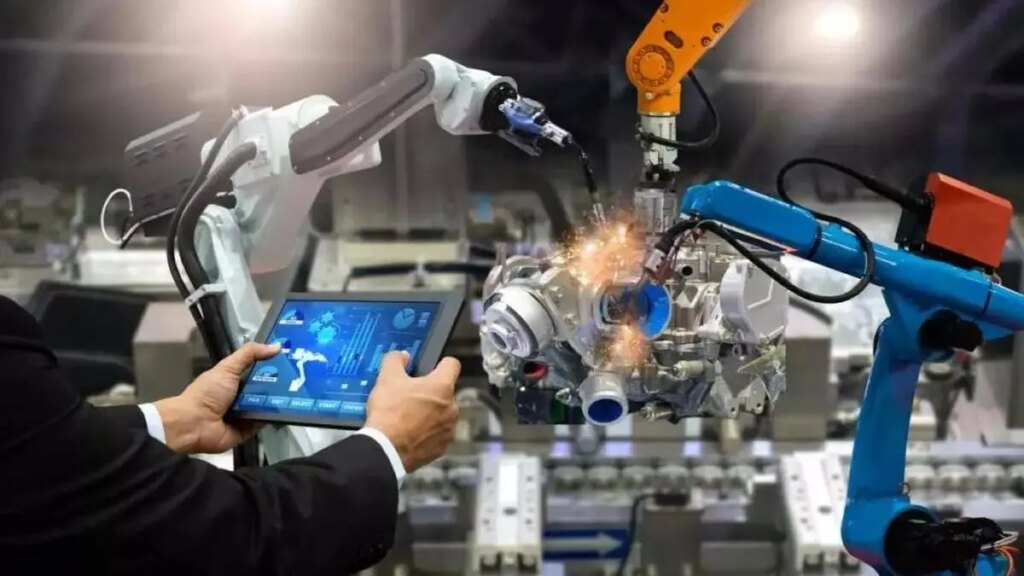

Driven by its focus on high-mix, low-volume production, Unimech Aerospace & Manufacturing specialises in complex, high-precision aero tooling, GSE, electromechanical sub-assemblies and precision components. Led by advanced manufacturing and strong OEM/licensee relationships, it plans to penetrate deeper into aerospace and nuclear energy, while diversifying into other high-mix, low-volume sectors organically and inorganically.

The company has a dynamic management team at its helm, enabling them to achieve about 35 per cent growth on sustainable basis and achieve nearly 37.5 per cent + RoIC by FY27.

The company specialises in critical parts, example aero tooling, ground support equipment and precision components.With a strong vendor network, the company scales up production efficiently, ensuring optimal asset utilization and effective working capital management.

The company’s 1,80,000 sq ft manufacturing facility would be expanded to 3,30,000 sq ft by Mar’26, which would ensure significant growth. Its digital-first strategy (supported by in-house ERP systems) is driving wallet-share gains in the aeroengine tooling segment.

Valuation. The company is strategically positioned to capture structural tailwinds in aerospace, defence and energy sectors. Additionally, the pre-IPO capital raise offers multiple growth opportunities, while ongoing capacity expansions provide the flexibility to scale up.

Key risks. High dependency on top five customers; significant segmental contribution from aerospace; heavy dependence on exports and regional performances.