Mutual fund schemes holding investments in IndusInd Bank shares have registered a sharp erosion in value after the stock fell over 30 per cent in the last two trading days to ₹656 a share on Tuesday against ₹936 logged in last Friday.

Shares of the bank hit a new 52-week low of ₹649 on Tuesday after the bank disclosed a 2.4 per cent impact on its net worth due to changes in the valuation of derivative transactions.

As of February, 35 mutual funds and about 360 schemes collectively held over 20.88 crore shares of IndusInd Bank. The value of their holdings was at ₹20,670 crore but declined by ₹6,970 crore to about ₹13,700 crore on Tuesday. Besides actively managed funds, the passive funds were also impacted by IndusInd Bank as it was part of many indices.

Five AMCs had over ₹1,000 crore exposure in the bank. ICICI Prudential MF had the highest exposure of about ₹3,778 crore and owned 3.81 crore shares in its portfolio in February.

HDFC MF and SBI MF owned shares worth ₹3,564 crore and ₹3,048 crore. Other major holders include UTI, Nippon India, Bandhan, and Franklin Templeton MFs, with investments ranging from ₹740 crore to ₹2,447 crore.

Kotak MF and Tata MF had shares worth ₹522 crore and ₹517 crore as of February-end. Quant MF had about 30.77 lakh shares in its portfolio which were valued at ₹305 crore.

MF: Risk exposures

Between April 2024 and January 2025, IndusInd Bank received mutual fund inflows worth ₹10,200 crore. However, February 2025 saw an outflow of about ₹1,600 crore.

Nikunj Saraf, VP, Choice Wealth, said besides erosion in NAV of schemes that are holding the bank shares, the issue that needs to be addressed is due-diligence done by fund managers on its risk exposures before allocating capital as MFs are charging a fee on investors for proactively managing risks.

Given that many Indian banks have overseas operations and derivative exposures, it is imperative for the RBI to step in and conduct a strict audit to ensure that other banks also do not come up with similar googly, he added.

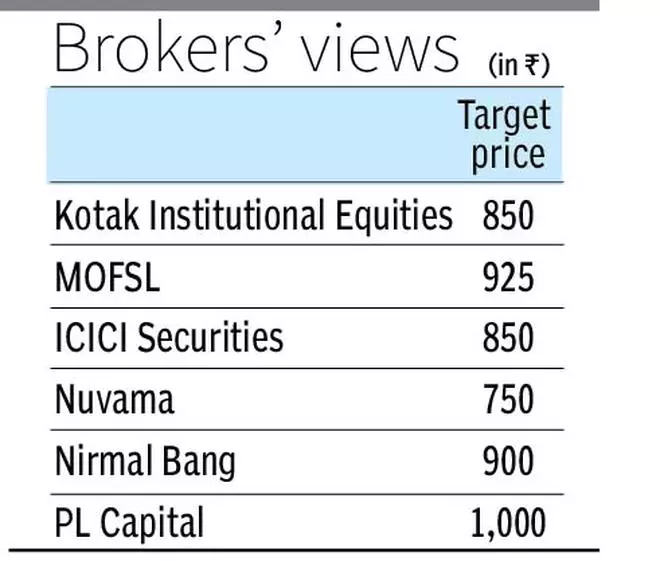

Meanwhile, Kotak Institutional Equities reduced its target price on the stock to ₹850 from ₹1,400, while downgrading the stock to ‘Reduce’ from ‘Buy’. MOFSL suggested a revised target price of ₹925. ICICI Securities suggested a target price of ₹850. Nuvama sees the stock at ₹750 while Nirmal Bang pegs the stock at ₹900. PL Capital predicts the stock at ₹1,000.

Ajay Garg, CEO, SMC Global Securities, said despite the concerns, the bank’s profitability, reserves and capital adequacy ratios remain strong enough to absorb the discrepancies.

In parallel, he said the bank has also appointed a reputed external agency to independently review and validate the internal findings. On the discrepancies, the bank’s management clarified that they pertain solely to the bank’s own borrowings and do not involve any client trades, he said.