Revenue from Indian operations increased 5 per cent on a quarterly basis at ₹34,700 crore, driven by a 6 per cent increase in sales volumes to 5.60 million tonnes

| Photo Credit:

FRANCIS MASCARENHAS

Target: ₹145

CMP: ₹157.35

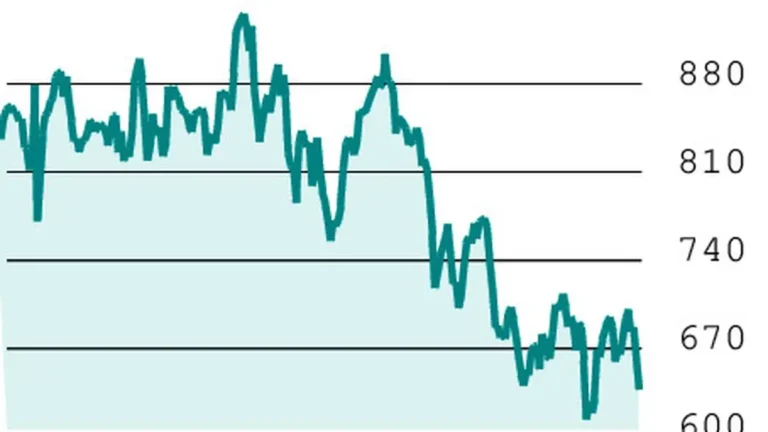

Tata Steel’s Q4FY25 profitability exceeded our expectations. Revenue rose 5 per cent quarter on quarter (qoq) at ₹56,200 crore, driven by 8 per cent q-o-q volume growth, despite a 3 per cent q-o-q drop in realisations. Volume growth was supported by strong performance across both India and European operations. Consolidated EBITDA increased 11 per cent on a quarterly basis to ₹6,600 crore, with EBITDA/tonne rising 3 per cent to ₹7,874. The UK operations reported an EBITDA loss of ₹13,758/tonne in Q4FY25 compared with a loss of ₹12,965/tonne in Q3FY25. Meanwhile, the Netherlands operations turned EBITDA positive at ₹712/tonne in Q4FY25, compared with a loss of ₹7/tonne in Q3FY25, supported by cost reductions and operational efficiencies.

Revenue from Indian operations increased 5 per cent on a quarterly basis at ₹34,700 crore, driven by a 6 per cent increase in sales volumes to 5.60 million tonnes. This was led by strong demand from the retail segment and seasonality. However, realisation declined 1 per cent on quarter to ₹61,895 per tonne due to the weak steel prices amid a surge in cheap steel imports. EBITDA per tonne decreased 12 per cent qoq to ₹13,250/tonne, due to increased other overheads.

Deliveries in the Netherlands grew 14 per cent, leading to a 7 per cent q-o-q increase in revenue. However, a 7 per cent q-o-q drop in realisations tempered the overall benefit. The UK operations witnessed an 11 per cent q-o-q increase in volumes, leading to a 6 per cent q-o-q revenue growth. However, realisations dropped 4 per cent on quarter as the UK business focused on servicing downstream capacities using substrates from India and the Netherlands. This led to a higher q-o-q EBITDA loss in the UK due to elevated substrate costs during the quarter.

We slightly tweak our FY26 and FY27 EBITDA estimates and assign an EV/EBITDA multiple of 6.5x to FY27E EBITDA to derive target price of ₹145 and maintain HOLD rating on the stock.

Published on May 15, 2025