Domestic markets are likely to open flat on Thursday amid mixed global cues. Gift Nifty at 24,760 signals marginal gains for Nifty at open. However, analysts expect profit-taking to keep the market in a range and cap gains. The market is in consolidation mode, said analysts, and they do not expect a sustained rally. According to experts, sector rotation and profit booking will keep the market in a consolidation phase.

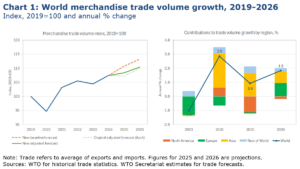

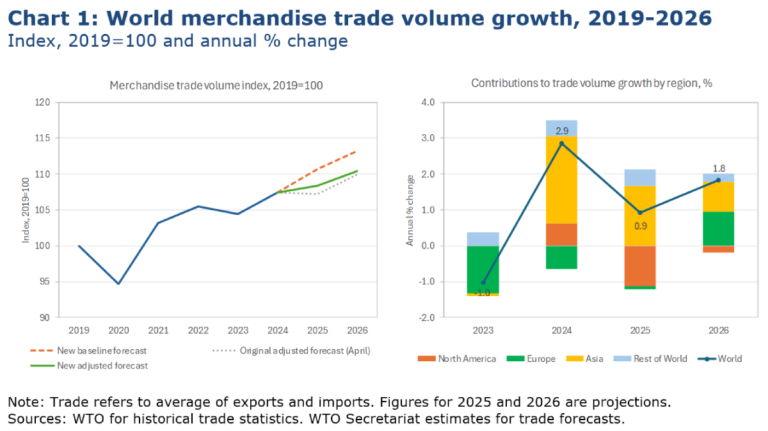

Franklin Templeton India Mutual Fund forecasts that Indian equity markets are likely to enter a consolidation phase rather than continue their recent momentum-driven trend, citing global uncertainties and sustained supply of new equity issuances as potential drags on market performance in FY26. “The global backdrop remains unclear, with trade policy uncertainty and tariff hikes weighing on capital expenditure decisions”, said R. Janakiraman, CIO – Franklin Equity India. “This environment has prompted many companies to delay private capex decisions in search of more policy clarity,” he added.

The fund house cautions that elevated levels of fresh equity supply could dampen near-term equity returns. While large-cap valuations now appear attractive, mid-and small-cap segments remain above their long-term averages, reinforcing the importance of diversification across market capitalisations and sectors.

According to the ICICI Prudential Mutual Fund, key global economic risks include a slowing global economy, geopolitical tensions, and tariff turmoil. However, India’s long-term structural strength is supported by several factors, such as capex and consumption cycles, sound balance sheets, and prompt policy reforms.

JM Financial said large, mid and small-cap indices are all trading 1 (standard deviation) or more above the mean, which implies that absolute valuations are not cheap. Looking at FY26E absolute P/E, one might interpret that relatively midcaps are the most expensive (Nifty Midcap 100 at 29.3x), followed by small caps (Nifty Smallcap at 25.2x), and large caps being the cheapest (Nifty50 at 20.6x). However, if one looks at FY26E PEG, one might interpret that midcaps are the cheapest (Nifty Midcap 100 at 1.3x), followed by small caps (Nifty Smallcap 100x at 1.7x) and large caps being the most expensive (Nifty50 at 1.9x)

According to the domestic brokerage, the EPS downgrade cycle is not over; on April 25, Nifty50 EPS estimates for FY25 increased by 0.3 per cent, while FY26/27 estimates increased by 1.1/1 per cent.

Meanwhile, Asian stocks are mixed. Japan and Korea are down, even as Taiwan and Singapore equities eked out marginal gains.

The derivatives data now leans mildly bearish, said Dhupesh Dhameja, Derivatives Research Analyst, SAMCO Securities.

Call writers have become increasingly aggressive at higher levels, forcing unwinding of put positions—a classic sign that bullish conviction is starting to fade, he said.

“A dense concentration of Open Interest between 24,700 and 24,900 reflects strong overhead barriers. The Put-Call Ratio (PCR) has nudged up from 0.69 to 0.73—indicating an uptick in bearish leaning. Meanwhile, Max Pain is parked at 24,550, hinting that the market is poised for a directional jolt.,” he added.

India’s VIX cooled off by 5.3 per cent, ending at 17.22. “Though the dip suggests easing nerves after global jitters, its position above 15 means volatility can reappear at short notice. Traders are advised to stay agile and maintain tactical positioning,” he cautioned.

Published on May 15, 2025