“Our SEBI FPI outreach cell is committed to addressing individual issues on a case-by-case basis,” the official said

SEBI is working on resolving fund repatriation delays for foreign portfolio investors (FPIs) on a case-by-case basis, as lingering issues in the T+1 settlement cycle threaten to derail its move towards same-day T+0 settlement, according to sources directly aware of the matter.

Despite ensuring that tax certificates are issued same day since October, some FPIs still face hold-ups in receiving trade proceeds — often caught in a blame-game between brokers and custodians. System glitches, technical issues and regulatory compliances can delay transactions at the brokers’ end.

“We checked with several large custodians — they claim they are making funds available the same day. However, we have also heard that there may be some issues. During the Chairman’s US trip to meet investors, we have advised all FPIs to reach out to us directly, if they face delays/ issues on accessing funds on T+1 itself,” said a senior SEBI official.

“Our SEBI FPI outreach cell is committed to addressing individual issues on a case-by-case basis,” the official said. SEBI has also asked all FPIs facing delays to write to: fpioutreach@sebi.gov.in.

Lingering delays

Until October last year, a key problem delaying the repatriation to T+2 instead of T+1 lay with the tax firms not being able to issue tax certificates the day of the trade — a prerequisite for moving money out of the country. While the certificates are now being issued on time, some FPIs continue to face delays for other reasons.

“Getting money out of India is difficult. We don’t know where the problem lies — whether it is the custodians holding on to the money, the brokers, or the foreign exchange window. But this is a problem,” said a person representing multiple FPIs.

According to a senior official at a global asset manager, delays in repatriation often result in custodians and brokers pointing fingers when asked to explain the hold-up.

“Streamlining the issuance of tax certificates helped solve one part of the problem, but other issues in the ecosystem remain. The only way we figure it out is if we come together as a group, with SEBI being the arbitrator, listening to all the different parties,” the official said.

T+0 hurdles

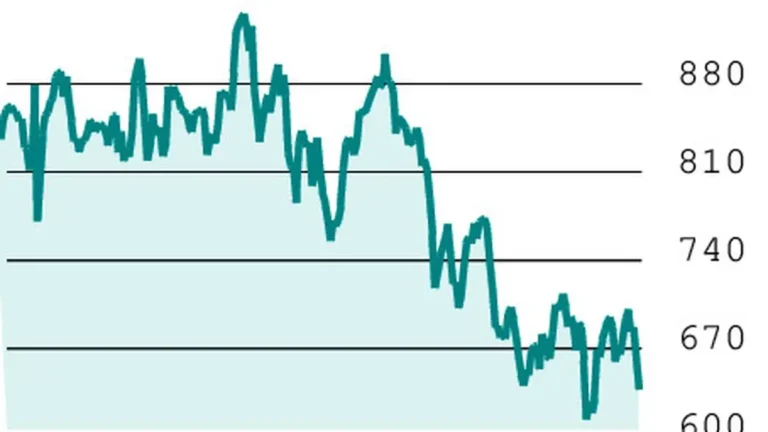

India transitioned to a T+1 settlement cycle for equities in January 2023, becoming the fastest major market to do so. A year later, the market regulator set its goal towards optional T+0 and potentially even instantaneous settlements.

Starting with just 25 scrips, the optional T+0 settlement was extended to the top 500 stocks from January 31, 2025, in a phased manner. SEBI has asked qualified stock brokers to put the necessary systems and processes in place for seamless investors participation in the optional T+0 settlement cycle by November.

FPIs have already raised doubts about T+0 as it will require a complete overhaul of the trading and settlement processes for those trading globally in numerous markets, higher impact costs, pricing discrepancies and increased complexity.

As foreign investors operate across time zones, quicker settlement makes their operational windows tight, rushing through currency conversion, bank settlement and document processing. Adding the ongoing repatriation delays with T+1, even for some FPIs and trades, makes their case against the shift to T+0 stronger.

Published on May 13, 2025