New Delhi, May 13 (KNN) The sharp depreciation of the US dollar over the past three months has become a growing concern for Indian IT companies, particularly those with a high concentration of USD-denominated revenues.

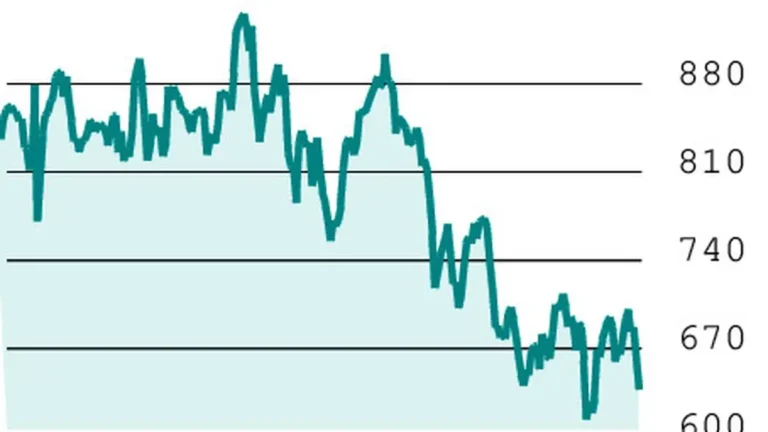

The USD has depreciated approximately 4 per cent against the Indian Rupee (INR), with even sharper declines against the Euro (7.6 per cent) and British Pound (9.9 per cent).

The appreciation of the INR is expected to negatively impact the profitability of Indian IT companies, particularly mid-tier firms with significant offshore exposure and limited currency hedging strategies.

According to a recent analysis by Kotak Institutional Equities, the extent of the impact on earnings will depend on factors like effort mix, currency exposure, profitability, and hedge policies.

Companies like Persistent, Mphasis, and Wipro, which have high US revenue exposure, are anticipated to face the greatest downside risks. The impact is expected to be more pronounced for firms with lower profitability levels.

Over the past three months, the INR has appreciated 3.5 per cent against the USD, with notable fluctuations in May, including a 1.5 per cent drop on May 7 and a 1.3 drop on May 8.

Despite this, Kotak’s report suggests that the weakening of the USD against other currencies such as the Euro and GBP will partially offset the INR’s appreciation.

Large IT companies, with lower exposure to the USD, will see a modest impact on earnings, while mid-tier companies with significant US revenue concentration will experience a greater impact.

The report estimates a 2-8 per cent hit to earnings in FY26, with the highest impacts on Persistent, Indegene, and Mphasis.

Companies like LTIM, TechM, and LTTS, which have long-duration hedging policies, are expected to be insulated from these fluctuations, offsetting currency impacts at the EBIT level with FX gains.

In the current cost-sensitive environment, sustained USD weakness could further pressure the sector’s profitability, especially for firms with limited margin flexibility.

(KNN Bureau)