Shares of UPL Ltd tumbled 5 per cent as brokerages remain divided on the stock despite 21x surge in Q4 profit.

The company on Monday reported a profit of ₹896 crore for the quarter ended March 2025, as against ₹40 crore in the corresponding quarter of the previous year, on higher revenues.

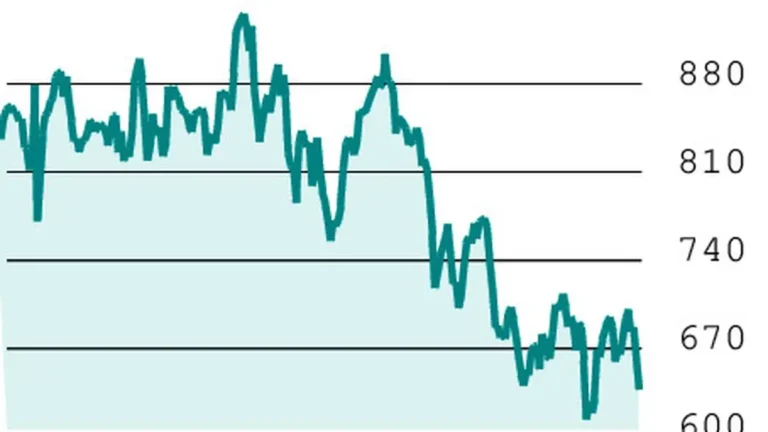

Global brokerage Jefferies has maintained buy at a target price of ₹810 per share, signalling a 20 per cent upside potential from the previous close.

Nuvama Institutional Equities moderated FY26 estimates marginally to factor in a gradual pick-up in volumes and reckon FY27 will log accelerated growth, led by the NPP portfolio ($1.5 billion target by FY30), specialty chemicals business and global crop protection business. The brokerage has maintained buy call at a revised target price of ₹781.

Nuvama believes that the company’s balance sheet is well positioned, given the strong internal cash generation, improved working capital cycles and asset-light growth in seeds and specialty chemicals.

Motilal Oswal said UPL witnessed resilient growth in the second half of FY25 despite macro headwinds. Its EBITDA rallied 68 per cent y-o-y, driven by demand recovery, a better product mix, rebate normalisation, and lower COGS (cost of goods sold). Motilal has reiterated a neutral rating at a target price of ₹660 on the stock.

Elara Capital analysts observed that UPL has aggressively reduced its cost structure and shrunk working capital requirements, which are likely to continue in FY26. Retaining buy, Elara has increased the target price on the stock from ₹664 to ₹749. However, analysts reduced the EBITDA estimates for FY26 by 7 per cent and for FY27 by 6 per cent to factor in low product realisations.

The stock closed 5.17 per cent lower on the BSE at ₹640.95.

Published on May 13, 2025