Prudent Corporate Advisory Services, an independent retail wealth management company, reported that its net profit in the March quarter was up 16 per cent to ₹51 crore against ₹45 crore logged in the same period last year.

Revenue was up 18 per cent at ₹283 crore (₹240 crore) and operating profit increased 13 per cent to reach ₹69 crore (₹61 crore).

In FY25, the net profit was up 41 per cent at ₹196 crore (₹139 crore) while revenue jumped 37 per cent to ₹1,104 crore, largely driven by a 43 per cent increase in yearly average AUM in the mutual fund segment.

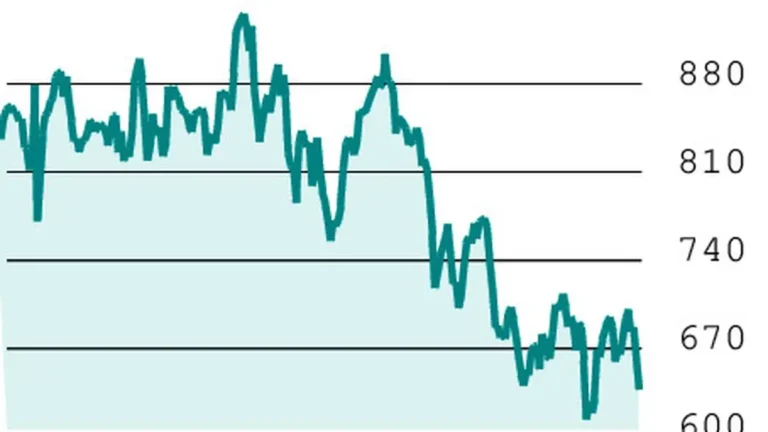

Equity AUM grew by 25 per cent in FY25 to ₹1 lakh crore, driven by robust net sales of ₹12,606 crore — a 105 per cent increase over FY24.

The monthly Systematic Investment Plan (SIP) book grew by 35 per cent in March reaching ₹981 crore.

Drawing an analogy, Sanjay Shah, Managing Director, Prudent Group, said in the 1980s, the US witnessed a threefold increase in per capita GDP over two decades, but the real story was in the financial markets where the mutual fund industry expanded by an unprecedented 52 times, unlocking massive retail participation and long-term wealth creation. India now stands at a similar inflection point and domestic mutual fund industry is projected to grow 42 times to nearly ₹2,800 lakh crore, translating to a robust CAGR of 18–19 per cent, he said.

Th company is fully aligned with this long-term vision and exceptionally well-positioned to lead and thrive in this evolving landscape, he added.

Published on May 13, 2025