Despite Foreign Institutional Investors (FIIs) turning net sellers in Indian equity markets during financial year 2024-25 with outflows totalling ₹1.27 lakh crore across seven months, certain companies continued to attract strong and consistent interest from these investors.

The data compiled from the Capitaline database reveals that 118 companies experienced quarter-on-quarter increases in FII holdings throughout the year. 750 companies part of Nifty total market index taken into account for the study.

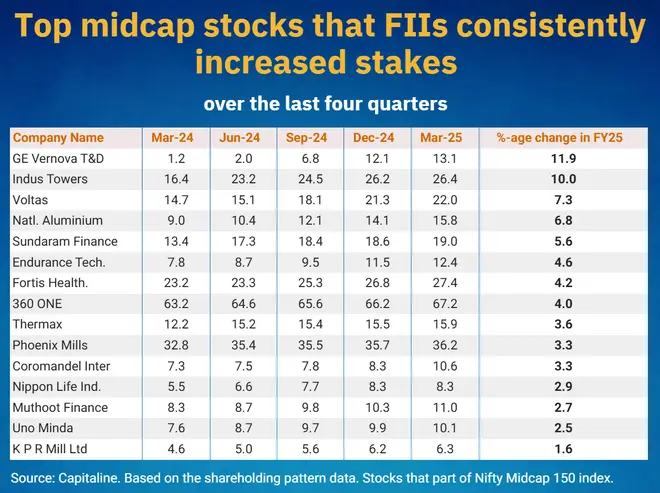

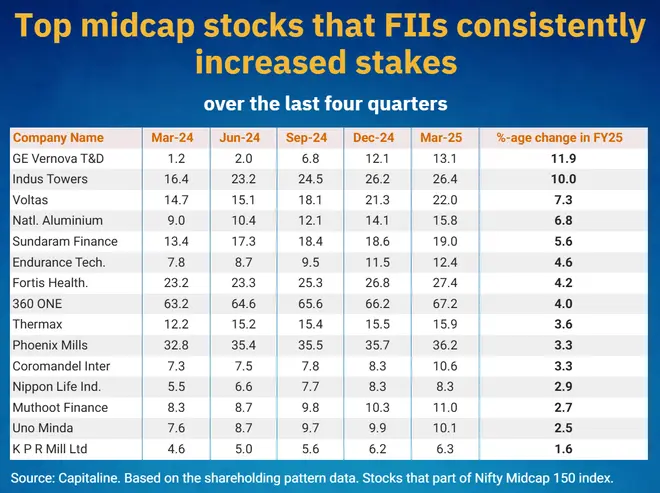

Within the Nifty Midcap 150 index, 21 stocks attracted consistent inflows from foreign investors. Most notable among these were GE Vernova T&D, where FII stake rose dramatically from 1.2 percent to 13.1 percent, Indus Towers with an increase from 16.4 percent to 26.4 percent, and Voltas, which saw FII holdings grow from 14.7 percent to 22 percent. These stocks were held by 352, 827, and 603 FIIs respectively as of March 2025.

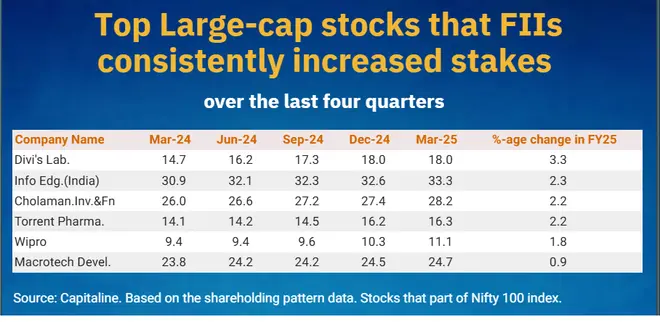

In the large-cap segment, Wipro stands as the only Nifty 50 constituent that saw consistent FII investment increases across all four quarters. Other large-caps that attracted steady foreign investment included Cholamandalam Investment and Finance, Torrent Pharma, Info Edge (India), Divi’s Laboratories, and Macrotech Developers.

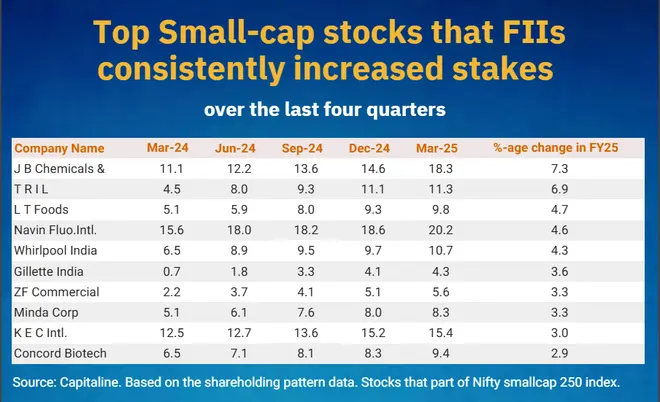

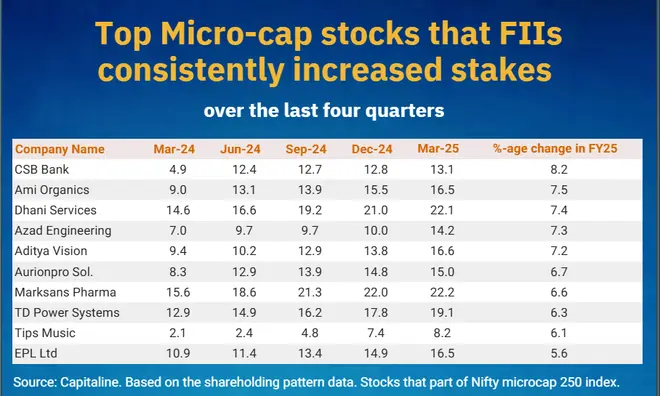

The Nifty Smallcap 250 index featured 20 companies with consistent FII inflows, with CSB Bank, Ami Organics, and Dhani Services leading the pack with increases of 8.2 percent, 7.5 percent, and 7.4 percent in FII holdings respectively.

Additionally, 35 microcap stocks also garnered significant and consistent investment from foreign institutional investors during FY2025.

Sector-wise, FIIs significantly reallocated assets within Oil & Gas, Financial Services, and FMCG, while simultaneously increasing investments in Telecommunication, Healthcare, and Realty sectors.

Published on April 28, 2025